Financial performance

3.1 As explained in Chapter 1, the financial performance measure (FPM) for Network Rail compares its income and expenditure to the CP6 delivery plan (set in 2019). If a region has spent less or has received more income than the baseline for what it has delivered, it will report financial outperformance, and vice versa. Our CP6 regulatory accounting guidelines explain further how FPM is calculated.

3.2 As shown in Table 3.1, Network Rail Scotland financially underperformed by £482 million over CP6 as a whole and by £129 million between April 2023 to March 2024.

Table 3.1: Network Rail Scotland’s financial performance

| £ million (cash prices) | 2023-24 | 2023-24 | 2023-24 | CP6 | CP6 | CP6 |

|---|---|---|---|---|---|---|

| Actual | FPM out / (under) performance | % of FPM contribution | Actual | FPM out / (under) performance | % of FPM contribution | |

| Grant income | 596 | 0 | 0% | 2,945 | 0 | 0% |

| Franchised track access charges | 519 | 2 | 1% | 2,085 | (32) | (7%) |

| Other income | 62 | 3 | 3% | 222 | (19) | (4%) |

| Total income | 1,176 | 5 | 4% | 5,251 | (51) | (11%) |

| Schedule 4 | 16 | 17 | 13% | 157 | (68) | (14%) |

| Schedule 8 | 19 | (18) | (14%) | 63 | (40) | (8%) |

| Network operations | 75 | (21) | (16%) | 318 | (53) | (11%) |

| Support costs | 126 | (38) | (29%) | 507 | (70) | (15%) |

| Traction electricity, industry costs and rates | 106 | (0) | (0%) | 408 | (0) | (0%) |

| Maintenance | 216 | (49) | (38%) | 941 | (125) | (26%) |

| Total operating expenditure | 557 | (111) | (86%) | 2,393 | (358) | (74%) |

| Renewals | 466 | (22) | (17%) | 2,182 | (70) | (15%) |

| Enhancements | 152 | (1) | (1%) | 856 | (3) | (1%) |

| Total capital expenditure | 618 | (23) | (18%) | 3,038 | (73) | (15%) |

| Financing costs and other | 262 | 0 | 0% | 1,340 | 0 | 0% |

| Other expenditure | 262 | 0 | 0% | 1,340 | 0 | 0% |

| Total expenditure | 1,437 | (134) | (104%) | 6,771 | (431) | (89%) |

| Financial performance measure | (129) | (482) |

Source: ORR analysis of Network Rail’s data. Numbers may not sum due to rounding.

Expenditure

3.3 Network Rail Scotland spent £6.8 billion over CP6 as a whole, spending £1.4 billion in the final year of CP6. We note the significant impact that inflation has had on expenditure over the control period.

Schedules 4 and 8

3.4 Approximately 3% of Network Rail Scotland’s expenditure in CP6 was spent on Schedules 4 and 8.

3.5 Under the Schedule 4 mechanism, Network Rail must compensate train operators for planned possessions and cancellations.

- Over CP6 as a whole, Schedule 4 costs in Scotland were £157 million, £66 million higher than the 2019 delivery plan, with £68 million of financial underperformance recognised. This was largely driven by underperformance in April 2022 to March 2023, due to industrial action.

- Between April 2023 and March 2024, Schedule 4 costs in Scotland were £16 million, £15 million lower than the delivery plan, with £17 million of outperformance recognised. This was partially as a result of the region planning work early, but also due to favourable settlements of commercial claims from 2019 to 2020. This has helped to make up for some of the underperformance seen in 2022 to 2023 when industrial action disrupted network availability.

3.6 The Schedule 8 mechanism provides a basis for compensation to train operators for the impact of lateness and cancellations on their income.

- Over CP6 as a whole, £63 million has been spent on Schedule 8 payments, £40 million higher than planned, with an underperformance of £40 million recognised. Increasingly volatile weather and asset failures have led to higher than anticipated compensation paid to operators.

- Schedule 8 costs in Scotland were £19 million in April 2023 to March 2024, an improvement on the prior year as a result of improved train performance. However, this was still £18 million higher than planned, with £18 million of financial underperformance recognised, largely due to disruptive weather affecting the ability to run trains to timetable.

Network operations costs

3.7 Approximately 5% of Network Rail Scotland’s expenditure in CP6 was spent on operations costs. Operations costs are mostly associated with the management of signalling, stations and other customer-facing services.

- Over CP6 as a whole, Network Rail Scotland spent £318 million on network operations, £55 million higher than the delivery plan, with £53 million of financial underperformance recognised. Higher costs are attributed to the COVID-19 pandemic, inflationary pressures, additional recruitment to reduce overtime and address an aging workforce, and compliance with fatigue management standards. Additionally, increased investment has been made to enhance services, performance, and resilience for the public.

- For the period from April 2023 to March 2024, Network Rail Scotland spent £75 million on network operations, £21 million higher than the delivery plan, with £21 million of financial underperformance recognised.

Support costs

3.8 Approximately 7% of Network Rail Scotland’s expenditure in CP6 was on support costs. Support costs refer to auxiliary activities Network Rail needs to undertake in order to facilitate the core business.

- Over CP6 as a whole, support costs were £507 million in Scotland, £89 million higher than the delivery plan, with £70 million of financial underperformance recognised.

- For the period from April 2023 to March 2024, support costs were £126 million in Scotland, £37 million higher than the delivery plan, with £38 million of financial underperformance recognised.

3.9 Network Rail Scotland incurred additional expenses to build local HR and finance capabilities. This reflects Network Rail’s ‘Putting Passengers First’ (PPF) strategy of devolving decision making to regions, closer to railway users. Additional costs also included COVID-19 related expenditure, inflationary pressures, legal and compensation costs for events such as the Stonehaven derailment, utility costs and redundancy expenses.

3.10 Despite these additional expenses, Network Rail Scotland achieved some savings from pay restraint, lower performance-related pay, lower consultancy expenses, decreased travel expenses and insurance savings.

Traction electricity, industry costs and rates

3.11 Approximately 6% of Network Rail Scotland’s expenditure in CP6 was on traction electricity, industry costs and rates, British Transport Police costs, ORR fees, the railway safety levy, Rail Delivery Group membership and independent reporters’ fees.

- Over CP6 as a whole, Network Rail Scotland incurred costs totalling £408 million for this category, which is £28 million lower than the delivery plan. This was mainly due to pre-purchasing energy at lower prices and reduced train services during the pandemic. Business rates were also lower than expected.

- For April 2023 to March 2024, Network Rail Scotland incurred costs of £106 million, £5 million higher than anticipated. This was largely due to rising electricity prices, as the pre-purchase protections were no longer in effect.

3.12 Network Rail has limited control over these costs, which are influenced by government and market forces. As such, these categories do not impact FPM.

Maintenance

3.13 Approximately 14% of Network Rail Scotland’s expenditure in CP6 was on maintaining the existing infrastructure in appropriate condition.

- Over CP6 as a whole, Network Rail Scotland spent £941 million on maintenance, £112 million more than its delivery plan. Scotland has attributed its £125 million underperformance to expenses responding to the COVID-19 pandemic, but also to additional investment in performance improvement schemes, track worker safety and the PPF reorganisation. There have also been increased Civil Examination Framework Agreement (CEFA) costs, and additional teams and resource required to maintain the newly electrified parts of the network in Scotland.

- For the period from April 2023 to March 2024, Network Rail Scotland spent £216 million on maintenance, £47 million more than its delivery plan, with £49 million of underperformance recorded. Budgetary pressures, chiefly caused by higher than expected inflation, necessitated a strategy away from renewals to more maintenance of existing assets. Costs also exceeded forecasts due to inflation, volatility in material prices and material availability.

Renewals

3.14 Approximately 32% of Network Rail Scotland’s expenditure in CP6 was on renewing infrastructure.

- Over CP6 as a whole, Network Rail Scotland spent £2,182 million on renewals. This is £75 million lower than its delivery plan. Due to the pandemic, industrial action, inflation, poor train performance and weather resilience concerns, Network Rail has had to reprioritise its funding elsewhere. This led to a reduction in renewals expenditure. Note that the financial performance measure includes adjustments based on the volumes of work completed and therefore underspending does not necessarily indicate outperformance. In fact, £70 million of financial underperformance has been recorded over the control period.

Renewals financial underperformance largely relates to inflationary pressures on contractor and material prices. Additional factors include the loss of economies of scale from reduced workbanks, design issues and unforeseen compensation to gain site access. Underperformance is also linked to high output plant failure, productivity losses due to industrial action and higher costs associated with the increased focus upon track worker safety, electrification, earthworks and drainage. - For the period from April 2023 to March 2024, Network Rail Scotland spent £466 million on renewals. This is £48 million higher than its delivery plan for the year, which offsets some of the underspends in earlier years of CP6. The region has managed risks elsewhere in the business this year, allowing more funds to be invested in renewals. Nevertheless, over the year, £22 million of financial underperformance has been recognised.

Enhancements

3.15 Approximately 13% of Network Rail Scotland’s expenditure in CP6 was spent on enhancement projects delivering new infrastructure capabilities. The majority of enhancements are funded by the government, however there are some schemes that are funded by other third parties.

- Over CP6 as a whole, Network Rail Scotland spent £856 million on government funded enhancements. This amount includes £13 million for capital portfolio-level commercial claims provisions held at a Network Rail level and includes contributions from the Active Travel Fund and roads funding for A9 projects. These enhancements are often excluded from Transport Scotland funded enhancements reporting because they are not considered core rail funding. The £3 million of financial underperformance recorded, largely relates to electrification programmes and associated compensation settlements.

- Enhancement expenditure in the year, paid for by Transport Scotland, was £152 million, broadly in line with its delivery plan, with £1 million of financial underperformance recognised.

3.16 Third party funded enhancement expenditure for CP6 as a whole was £33 million, of which £18 million related to April 2023 to March 2024. The 2019 delivery plan included no baseline for enhancements funded by third parties so we cannot report on the financial performance for third-party funded enhancements.

Risk Funding

3.17 In the 2019 delivery plan, £306 million of ring-fenced risk funding was set aside for unplanned costs. This was insufficient to manage the £545 million of unplanned costs Network Rail Scotland eventually faced over CP6 as a whole. These include but are not limited to the COVID-19 pandemic, weather events, performance related issues, industrial action and rising inflation.

3.18 As a result, Network Rail Scotland has had to find other means with which to cover these unplanned costs. Earlier in the control period, the company decided to defer £83 million of planned renewals to improve its ability to manage financial risks in the final two years of CP6. Scotland's risk fund has also been topped up through workforce reform and modernisation efficiencies.

3.19 Network Rail, Transport Scotland and ORR will continue to work closely over the next control period to ensure that risk funding is used in a transparent way and consistent with our CP7 guidance and annex A of our PR23 Final determination, in order to ensure value for money. This is especially important given the limited risk funding available for CP7, with only £225 million (2023-24 prices) or £234 million (cash prices) set aside in our final determination for CP7, significantly less than in CP6. As such, Network Rail Scotland will need to enhance its risk management over the next five years and may need to deliver additional efficiencies to address financial pressures if the risk fund proves insufficient.

Allocation of centrally managed costs to Scotland

3.20 During CP6 a number of central costs were devolved to Scotland, including Traction Power, Rates, Telecoms, On Track Plant and Property. Nevertheless, some costs incurred by Network Rail’s National Functions teams remain and these are re-charged to regions in proportion to their use of services provided by these functions and in accordance with the ORR’s CP6 regulatory accounting guidelines.

- In CP6, £1,969 million was recharged to Scotland (of which £1,340 million related to financing costs and includes index-linked debt, which is where the amount borrowed changes in line with inflation and is paid to debtholders at the end of a loan period). Overall, allocations of centrally managed costs are around 8% less than forecast in Network Rail Scotland’s original CP6 delivery plan. This is despite £224 million higher than expected financing costs.

- For the period from April 2023 to March 2024, £408 million was recharged to Scotland (of which £262 million related to financing costs). In this year, allocations of centrally managed costs are around 19% less than forecast in Network Rail Scotland’s original CP6 delivery plan. This is despite £41 million higher than expected financing costs.

3.21 These savings were possible due to savings across a number of central functions, namely as a result of economies of scale and through GB wide initiatives benefiting renewals costs in particular. Key contributors include workforce reform, decreased insurance expenses, advancements in technology and innovation, and research, development, and innovation (RD&I), especially in areas such as weather resilience, track, signalling, and overhead line equipment. Additional areas of savings include Route Services, earthworks remote monitoring, and telecommunications for CCTV.

Table 3.2: Allocation of centrally managed income and expenditure to Scotland

| £ million (cash prices) | 2023-24 | 2023-24 | 2023-24 | CP6 | CP6 | CP6 |

|---|---|---|---|---|---|---|

| Actual | Delivery plan | Variance Better / (Worse) | Actual | Delivery plan | Variance Better / (Worse) | |

| Infrastructure cost charges | 15 | 13 | 1 | 65 | 62 | 2 |

| Schedule 4 access charge supplement | 7 | 6 | 1 | 18 | 17 | 1 |

| Traction electricity, industry costs and rates | 0 | 0 | 0 | 64 | 80 | (16) |

| Freight traction electricity charges | 0 | 0 | 0 | 1 | 1 | 0 |

| Property rental | 1 | 3 | (2) | 21 | 31 | (10) |

| Property sales | 1 | 3 | (2) | 3 | 9 | (6) |

| Total income (excluding grants) | 24 | 26 | (2) | 172 | 201 | (29) |

| Schedule 4 | 0 | 2 | 2 | 1 | 11 | 9 |

| Schedule 8 | 0 | 0 | 0 | (8) | 2 | 10 |

| Network operations | 2 | 2 | 0 | 10 | 10 | 0 |

| Support costs | 80 | 68 | (12) | 327 | 317 | (11) |

| Traction electricity, industry costs and rates | 5 | 4 | (1) | 152 | 165 | 13 |

| Maintenance | 8 | 7 | (1) | 40 | 37 | (3) |

| Renewals | 74 | 116 | 42 | 265 | 333 | 68 |

| Enhancements | 0 | 0 | 0 | 13 | 0 | (13) |

| Risk expenditure (route controlled) | 0 | 108 | 108 | 0 | 306 | 306 |

| Risk expenditure (centrally held) | 0 | (10) | (10) | 0 | 9 | 9 |

| Financing costs | 262 | 222 | (41) | 1,340 | 1,116 | (224) |

| Taxation | 0 | 9 | 9 | 0 | 27 | 27 |

| Total expenditure | 432 | 528 | 96 | 2,141 | 2,334 | 193 |

| Net expenditure | 408 | 502 | 94 | 1,969 | 2,133 | 163 |

| excluding financing, taxation and risk expenditure | 146 | 163 | 17 | 629 | 684 | 55 |

Source: ORR analysis of Network Rail’s data. Numbers may not sum due to rounding.

3.22 The saving compared to the delivery plan assumptions in Scotland were smaller than the overall GB position (16% lower than planned in GB vs 8% lower in Scotland over CP6 as a whole). This was largely a result of property disposals in England & Wales as well as an increase in relative headcount in Scotland compared to the other regions, which is one of the main drivers referred to when allocating central costs.

Income

3.23 Network Rail Scotland received £5.3 billion of income over CP6 as a whole and £1.2 billion in April 2023 to March 2024 (excluding enhancement grants).

Network grant funding

3.24 The main source of income for Network Rail Scotland is through network grant funding from the Scottish Government. This funding is for operating, maintaining, supporting and renewing the railway infrastructure.

- Network Rail Scotland received £2,245 million in network grant funding over CP6 as a whole. This is in line with the amount agreed in the 2019 Grant Funding Letter and matches our expectations as set out within our published 2018 Final Determination.

- Network Rail Scotland received £441 million in network grant funding in April 2023 to March 2024. This differs to the 2019 Grant funding letter due to the phasing of funding across years of the control period. Oversight of the flexibility and phasing of grant payments within Scotland falls within the remit of Transport Scotland and the Scottish Government’s budget flexibility process.

3.25 Grants are deemed uncontrollable by Network Rail and are therefore considered neutral when assessing financial performance.

Other grant funding in Scotland

3.26 There are separate grant income arrangements with DfT to pay for Network Rail Scotland’s share of financing costs, British Transport Police and corporation tax.

- Over CP6 as a whole, Network Rail Scotland received £699 million of other grant funding, £108 million less than set out in the delivery plan for the control period. This is largely because of changes in legislation and in forecasts compared to the start of the control period. This has meant that the tax payable in the control period is lower than planned, which results in reduced revenue grants required from DfT.

- For the period from April 2023 to March 2024, Network Rail Scotland received £155 million for these, £12 million less than set out in the delivery plan for the year. Network Rail recognised a rebate from HMRC for corporation tax overpaid earlier in the control period and consequently there was a reduction in the revenue recognised from DfT to pay this tax in 2023 to 2024.

Franchised track access charges

3.27 Franchised track access charges are paid by franchised train operating companies that run on Network Rail’s infrastructure.

- Across the control period as a whole, track access income was £2,085 million, £23 million lower than planned, with £32 million of financial underperformance recognised. This is a result of there being lower variable income than planned, as fewer trains have run, particularly during the COVID-19 pandemic but also following changes in travel habits and as a result of industrial action.

- Between April 2023 to March 2024, track access charges income was £519 million, £41 million higher than planned, with £2 million of outperformance, offsetting some of the underperformances seen in earlier years of CP6. This comes as the industry begins to recover from the pandemic and industrial action but also as higher-than-expected inflation has led to additional amounts payable by operators under track access contracts (which are uplifted for inflation).

3.28 In line with our CP6 regulatory accounting guidelines, some variances in this category (including fixed infrastructure cost charges and traction electricity income) are considered neutral when assessing financial performance.

Other income

3.29 Other income includes freight and stations income, property rental and sales income, depots income and freight traction electricity income.

- Across the control period as a whole, Network Rail Scotland received £222 million of other income, £14 million less than planned, with £19 million of financial underperformance recognised. Property rental income is significantly lower than planned due to the COVID-19 pandemic and industrial action’s impact on passenger numbers and footfall.

- Between April 2023 to March 2024, Network Rail Scotland received £62 million of other income, £9 million more than planned, with £3 million of financial outperformance recognised. Depots income is higher than assumed, due to additional services offered to operators. This increase has helped offset lower-than-expected income from property and stations, as passenger numbers, though improved from the previous year, remain below pre-pandemic levels.

Enhancement grant funding

3.30 Aside from the network grant, Network Rail Scotland also receives enhancement grant funding (although this is not included under ‘income’ in Table 3.1). Enhancement funding supports projects that deliver new infrastructure capabilities and is considered more discretionary compared to essential maintenance and renewals, which ensure long term performance and safety and are covered by the network grant funding.

- Network Rail Scotland spent £856 million on enhancements to its network in CP6. This was funded by grants from the Scottish Government. The funding received by Network Rail Scotland was lower than the £1,114 million of cash funding set out in the Scottish Government’s 2019 Grant Funding Letter. The changes to the funding of enhancements were made through a formal change control process, overseen by Transport Scotland.

- Network Rail Scotland spent £152 million on enhancements in April 2023 to March 2024. This was funded by grants from the Scottish Government.

3.31 In addition to grant funding, Network Rail also spent £33 million on enhancements funded by other third parties, of which £18 million related to April 2023 to March 2024. This included upgrading the Ravenscraig line crossing to improve connectivity in the area.

Efficiencies

3.32 Efficiencies are the result of a positive action or initiative which has reduced the cost of delivery since the prior control period exit or has reduced the amount of work required to achieve the same outcome.

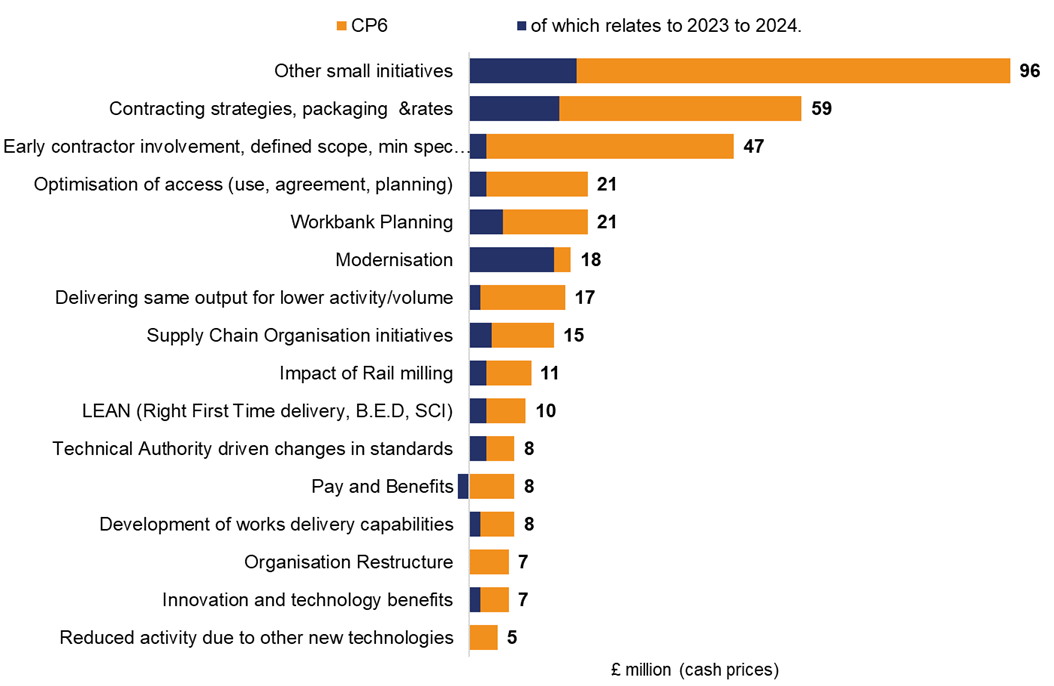

- Over CP6 as a whole, Network Rail Scotland reported £356 million of efficiency improvements, exceeding its 2023 delivery plan CP6 target of £349 million for the control period by around 2%. The largest initiatives over CP6 included contracting packaging and rates (£59 million), early contractor involvement, defined scope and minimum specification solution (£47 million), optimisation of access (£21 million) and workbank planning (£21 million).

- Between April 2023 and March 2024, Network Rail Scotland reported £79 million of efficiency improvements, exceeding its 2023 delivery plan target of £72 million for the year by around 10%. The largest three initiatives within the year included improved contracting strategies, packaging and rates (£16 million), modernisation (£15 million) and workbank planning (£6 million).

Figure 3.1: Network Rail Scotland’s main efficiency initiatives in CP6

Source: ORR analysis of Network Rail’s data

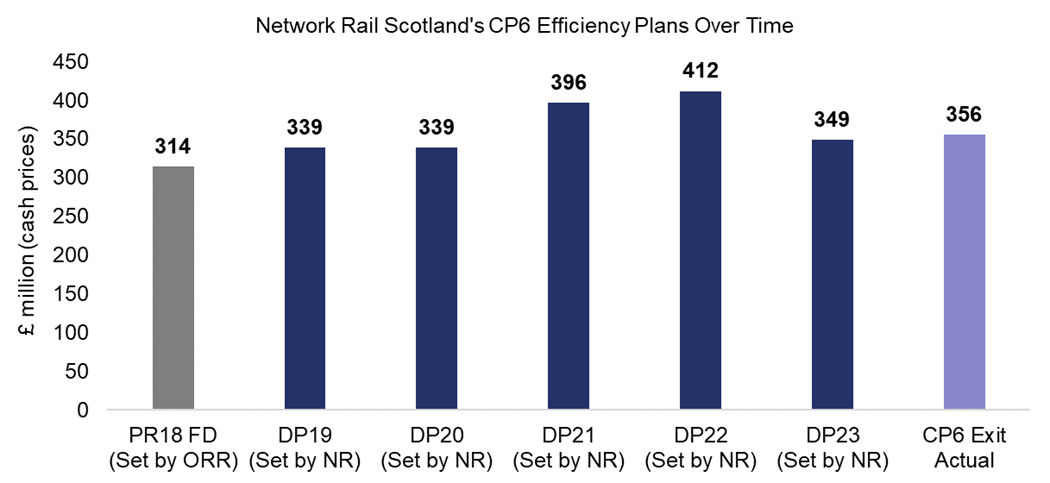

3.33 Network Rail Scotland’s efficiency delivery plans have undergone significant changes in CP6. Figure 3.2 shows that Network Rail Scotland’s 2023 delivery plan target for CP6 as a whole was less ambitious than in the two previous years. This was largely due to a deferral of planned renewals (due to high schedule 4 and 8 costs and the adverse impacts of the pandemic) and delays to the implementation of workforce reform initiatives.

Figure 3.2: Changes to Network Rail Scotland’s efficiency plans for CP6

Source: ORR analysis of Network Rail’s data

3.34 Whilst Network Rail Scotland has generally made good progress at improving its efficiency in CP6, it has underperformed on FPM. As explained in chapter 1 and in Annex B, this potentially counterintuitive result can be explained by structural differences between the two measures:

- Efficiency is compared to the final year of the previous control period, while FPM is measured against a delivery plan baseline (DP19).

- DP19 accounts for all expected efficiencies, so, all other things being equal, if the anticipated efficiency is achieved, the FPM would be zero.

- FPM covers income and expenditure, whereas efficiency focuses on operations, support, maintenance, and renewals expenditure only. The efficiency measure excludes income and enhancements expenditure.

- Certain cost drivers, such as the pandemic, inflation, and industrial action, are beyond Network Rail's control. These can negatively impact FPM but do not fall within the scope of efficiency reporting as these are separated out.

Headwinds, tailwinds, scope changes and input prices

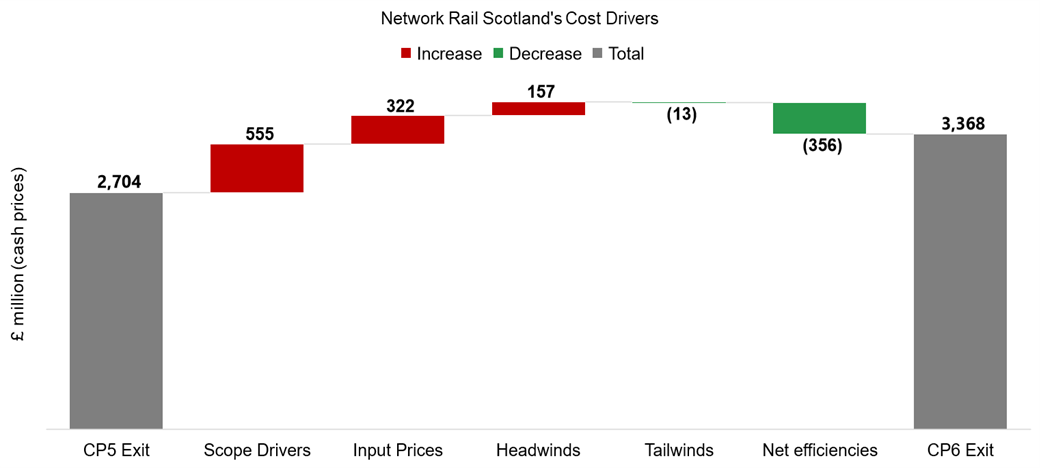

3.35 Figure 3.3 demonstrates the other drivers impacting Network Rail Scotland’s costs aside from efficiencies.

- Scope drivers refer to one-off events or changes to standards, legislation and scope since the CP5 exit.

- Inflation and Input prices refer to impacts of inflation and market pressures on costs.

- Headwinds encompass other cost drivers which increase the cost of delivery, which are beyond Network Rail’s immediate control.

- Tailwinds refer to cost drivers which decrease the cost of delivery, which are beyond Network Rail’s immediate control.

Figure 3.3: Network Rail Scotland’s cost drivers over CP6 (cash prices)

Source: ORR analysis of Network Rail’s data

*Note that this is for regional OSMR (operations, support, maintenance and renewals) efficiencies only and does not include all central efficiency allocations. Input prices in this chart include the £285 million impact of general inflation and a £36.5 million impact of market pressures.

Robustness of CP7 efficiency plans

3.36 Network Rail has targeted almost £3.7 billion (2023-24 prices) of efficiencies for Control Period 7 (CP7, 1 April 2024 to 31 March 2029), £410 million (including allocation of centrally delivered efficiencies) of which is to be achieved by Network Rail Scotland.

3.37 As explained in Chapter 2, we have commissioned Nichols Group to undertake an independent assessment of Network Rail’s preparedness to deliver its efficiency plans in the first two years of CP7.

3.38 The review considered a sample of high value efficiency initiatives within Network Rail Scotland as well as initiatives developed centrally by Network Rail’s Route Services Directorate and Technical Authority. The review entailed interviews across Network Rail’s teams and consideration of relevant documentary evidence.

3.39 Nichols found that the overall framework for managing and reporting efficiencies is more mature than it was at the equivalent point in CP6 and there was a good articulation of knowledge sharing and lessons learnt from CP6.

3.40 It was found that almost 80% of the initiatives were already relatively mature in development terms. Two thirds had a ‘high’ level of confidence of delivery.

3.41 The July 2024 efficiency documentation demonstrates a clear alignment of efficiencies to Delivery Plans and to the ORR’s Final Determination.

3.42 Nichols highlighted that calculations were provided for all initiatives sampled for Scotland. They were clear and sufficiently detailed and there was good evidence of robust, continuous assurance processes, with the use of challenge panels to address risks.

3.43 Nichols suggested that Network Rail Scotland could even exceed its target as it is prudently under-reporting its confidence levels for some initiatives, although Nichols agreed that the capex target for track renewals could be a challenge in Scotland.

3.44 Nichols highlighted that a key risk management tool applied is ‘over-planning’ the efficiency portfolio by aiming for greater efficiency than required to meet targets. The current scale of the over-plan indicates that Network Rail Scotland is in a good position to deliver its efficiency targets.

3.45 One recommendation Nichols made is that there could be a greater consistency in the approach to overplanning and use of overlays (to take the forecast back to target), supported by suitable analytical techniques. It highlighted that the application of overlays and unidentified items may be obscuring the view of real forecasts.

3.46 Nichols recommend that Network Rail addresses the lower level of regional confidence in central efficiency plans (for example Route Services Directorate enabled initiatives) that are then handed over to and delivered by the regions.

3.47 Nichols noted that further assurance and therefore more stability in the forecast is expected at Network Rail’s Scotland re-forecast, RF6 (September 2024) and RF9 (December 2024), but that overall, the current regional efficiency forecast is deemed reasonable.

3.48 Further details on Network Rail Scotland’s CP7 efficiency planning can be found in the report, which we will publish soon.