National Highways has continued to deliver its renewals and maintenance programme and in May 2024 the company achieved ISO55001 certification. This is a positive step in maturing its ability as an asset manager although the company needs to continue to improve.

National Highways is a mature severe weather operator and demonstrated high-level of compliance with its policies, processes and procedures to manage weather events such as rain, high winds, snow and ice.

There continues to be significant variances between National Highways’ planned and actual renewals programme delivered. The company has been unable to fully demonstrate reasons for this. Urgent and non-urgent defects continue to not meet expected timescales for rectification, and some aspects of its cyclic maintenance programme and inspections are not carried out on time. This increases the risk of road user exposure to defects.

In Year 4, we actively engaged with National Highways regarding the company’s ability to implement effectively its asset management strategy and policy. The company needs to improve its ability to evidence this and that it is achieving the benefits required. This is particularly evident where asset performance metrics, notably drainage resilience, technology availability, and pavement condition, are not realising an improvement in performance despite the volume of renewals delivered being significantly more than originally planned.

We will continue to hold National Highways to account to deliver its remaining RIS2 operation, maintenance and renewals programmes. The company needs to evolve to meet the challenges of delivering its future needs and expected programme for the next road period. It specifically needs to improve its governance for an expected increase in large strategic renewals projects as a result of the network age due to their significant cost and potential disruption to the network.

Asset Management Maturity

In May 2024 National Highways achieved certification against the requirements of ISO55001. Condition 5.11 of the company's licence states that it should adopt a long-term approach to asset management consistent with ISO55000 standards. The standard provides a framework for organisations to deliver good asset management through actively managing risk to improve performance. Achieving ISO certification is a positive step, and we expect the company to continue to mature its capability. We will continue to hold it to account to deliver its asset management plans to improve performance and embed asset management best practice.

Aligned to its work to achieve ISO55001 certification, National Highways has an established Asset Management Transformation Programme (AMTP) that sets out a range of actions it is taking to increase its asset management capability and maturity across the end-to-end asset management lifecycle. We have seen evidence of how individual actions have been delivered and the governance that drives this. However, the company is unable to fully evidence how these actions are embedded across the business and how performance has improved as a result. We require the company to take active steps to demonstrate this going forward.

During Year 4, National Highways provided us with evidence of the work it is doing in its Operations Directorate to improve the wider capabilities and performance of its operational teams. It has been delivering a programme of change called Operational Excellence 2025 (OE2025). This has focused on a range of positive activities that will improve efficiency, safety, build the capabilities of its people and deliver an improved customer experience. We will monitor how this is embedded across the business and expect the company to provide evidence to show how benefits and efficiencies have been realised.

National Highways acknowledges that improvement to asset data is required. This is to ensure it understands better the consequences and impacts of its activities on the performance and long-term resilience of the network and is able to make more effective and consistent decisions. As the network ages and condition deteriorates, the importance of the completeness and accuracy of asset data is more critical to mitigate the increased risks of unpredictable loss of asset performance. One of the key priorities within the AMTP is for the company to improve the quality of its data. This work is ongoing, and we will continue to hold National Highways to account through active engagement on how it is improving the quality and completeness of its data.

Operations

National Highways is responsible for ensuring the effective operation of the Strategic Road Network (SRN). This includes several operational activities such as severe weather planning, managing flood events, managing operational technology and logistical management of Traffic Officers. In the reporting year, we commissioned work to support holding National Highways to account with respect to its delivery of operational activity on the SRN.

Severe weather planning

In the reporting year, we engaged with National Highways to understand its approach to severe weather planning, management and service (SWPS). Severe weather includes a variety of weather events such as rain, high winds, snow and ice, elevated temperatures and fog. This is required to ensure effective operation and improve safety of the network.

We engaged with National Highways SWPS team and concluded it is a mature severe weather operator that provides a quality service with a high-level of compliance with its policies, processes and procedures. We will continue to engage with National Highways annually to understand its approach to SWPS.

Drainage resilience

Surface water on the network can pose a safety risk to road users and detrimentally impact asset integrity. National Highways manages the risk through understanding its drainage resilience. It has a performance indicator that measures the percentage of drainage catchments that have high risk flood hotspots. This provides an indication of the susceptibility of the SRN to flooding.

In our last annual assessment, we identified that drainage resilience performance had declined from the previous year. This trend has continued, as at March 2024, 36% of the SRN had an observed significant susceptibility to flooding i.e. 36% of the SRN has drainage catchments that include high risk flood hotspots. This is five percentage points worse than the previous year.

National Highways reported that this is because of a rising number of flooding events due to climate change and increased rainfall intensity. However, the company estimates that approximately 1 to 2% of the decline was attributed to rainfall exceeding its drainage asset design capacity. In the reporting year, we engaged with National Highways to evidence its ability to understand and manage its drainage assets.

National Highways recognises that its drainage asset information is one of its least mature asset datasets. The company must demonstrate the development and maintenance of high quality and readily accessible information about the assets held, operated and managed. It is important that the company prioritises improvement in this area so it can effectively and efficiently manage surface flooding on the network. We will continue to engage with National Highways in the next reporting year to ascertain its level of confidence and quality of asset data held and hold National Highways to account to improve drainage resilience.

Technology availability

National Highways uses technology assets to support its operation of the SRN. These include CCTV, electronic signs and weather stations. The technology availability performance indicator (PI) measures the percentage of time that roadside technology assets on the entire SRN are available, functioning and do not materially affect the service of the network. Although this metric is untargeted in RP2, National Highways has an internal target of 95% availability. In the reporting year the company reported a 12-month average of 91.4% availability. This is a reduction of four percentage points compared to the previous year.

Technology availability on smart motorways is reported separately in our annual assessment of safety performance on the SRN, which we published in December 2023. We reported that, as at September 2023, availability of stopped vehicle detection (SVD) on smart motorways was 99%. The average availability for four key technology asset types on smart motorways (CCTV cameras, motorway incident detection and automative signalling system (MIDAS), variable message signs and signals) was 95.6%. We continue to scrutinise the company’s progress towards its aim of achieving 97% availability for these four asset types on smart motorways by the end of RP2.

We continue to challenge National Highways to identify factors affecting the decline in the technology availability PI and actions the company is taking. Key focus areas where the company is taking action include outages due to local electricity providers, asset’s spares provision and a backlog of repairs that the company is progressing. A technology steering group has been established and we are assessing its efficacy to deliver the company’s proposed performance.

Maintenance

National Highways’ maintenance activities aim to keep the SRN safe and serviceable by undertaking routine cyclical work such as cutting vegetation, clearing drains and reactive repairs to defects such as potholes. Further detail can be found in our interactive dashboard.

Urgent defects

National Highways’ 2023-2024 delivery plan included a commitment to clear 90% of urgent defects it identified within 24 hours. Defects are classified as urgent if they could affect the safety of road users.

Between 2021 and September 2022, National Highways regularly achieved a quarterly clearance rate of 90%. In our last annual assessment, we highlighted that National Highways failed to address urgent defects across most defect types within 24 hours.

In the reporting year, National Highways' urgent defect performance has continued to fall below 90%, with a reported clearance rate of 87.4%, with most defect categories falling below 85%, evidencing poor maintenance performance. Further detail can be found in our interactive dashboard.

In the reporting year, we challenged National Highways to improve its clearance of urgent defects and conducted region-specific engagement to understand the reasons for poor performance. National Highways reported that the key drivers for inconsistency in performance are the embedment of its Maintenance and Response contracts and the competency and capacity of both National Highways and supply chain staff. National Highways has indicated that performance in Year 5 of RP2 is forecast to improve following improvements it has implemented. It is important that the company is able to demonstrate consistent delivery of urgent defect rectification to ensure that it does not realise an increase safety risk to users.

We will continue to work with National Highways to ensure that the plans it has in place improve urgent defect performance. This should include timebound plans and clear ownership that we will hold them to account to deliver.

Non-urgent defects and cyclic maintenance

In our last annual assessment, we highlighted that National Highways’ performance in addressing non-urgent defects, those that do not impact safety, within required timescales, decreased across most defect types. Whilst the company’s performance for non-urgent defects rectified to agreed timescales improved from a national total of 82.9% in Year 3 to 86.0% in Year 4, performance continued to deteriorate for a number of assets, including traffic signs, road markings and road studs.

Furthermore, National Highways’ performance in delivering programmed cyclical maintenance within required timescales was reported as 83.2% at the end of Year 4, a reduction from 86.0% in the first quarter of Year 4.

Whilst neither measure has a safety critical implication, if non-urgent defects are not rectified and the cyclic maintenance programme is not completed, then there is potential for safety critical, urgent defects to develop. This could then worsen road user safety risk as well as reduce asset life, thereby reducing efficiency and value for money.

We will work with the company to ensure that its plans improve all maintenance delivery in Year 5 of RP2. This is to ensure that the company is adopting a whole-life cost approach to managing its assets and delivering its plans in a timely manner to achieve value for money.

Planned inspections

National Highways delivers a wide-ranging programme of planned inspections of its assets each year to understand the asset condition and if any interventions are required. Failure to carry out inspections when scheduled has the potential to lead to reduced asset knowledge. Subsequently, there is a risk of less robust assessment of asset need, and a reduced ability to proactively plan interventions.

In the reporting year, National Highways delivered the majority of its planned inspection programme. However, it reported planned inspection programme completion rates of 54.2% and 71.2% for Vehicle Restraint Systems (VRS) and lighting, respectively.

National Highways has indicated that reasons for low completion rates for these assets are due to issues with supply chain resource and road space availability. The company has indicated that outstanding inspections will be prioritised in Year 5, and any safety risks are being mitigated by carrying out safety inspections and general condition inspections with any required works instructed reactively.

We will continue oversee National Highways planned inspection programme for the remainder of RP2 and call for improvements where they do not meet the requirements of the standards they have set out.

Renewals

Renewals delivery

Assets on the SRN, such as road surfacing and bridge structures, are renewed when they have reached the optimum asset life or are life expired, and need significant intervention to restore them to provide function that is required of them.

In the reporting year, National Highways spent in-line with its revised budget of £1,140 million. This budget is £141 million higher than the original renewals budget. The company increased the budget mid-year. It reported that it used the increased funding to address inflationary pressures; deliver additional work required for the concrete roads programme; and deliver other outputs, such as asphalt pavement, to support KPI3 delivery.

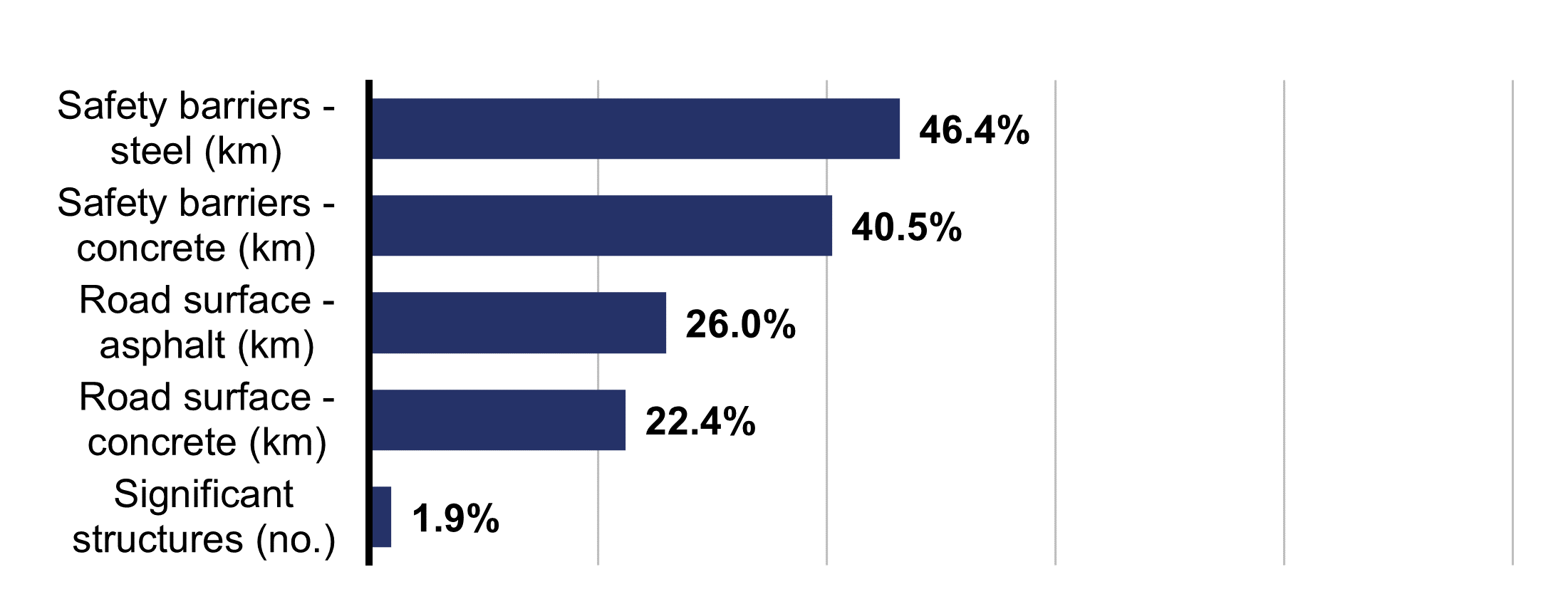

National Highways over-delivered all five types of planned major life-extension renewals in the reporting year, as shown in Figure 4.1. The company also over delivered on 12 of its 14 cyclical renewal types, including over delivery of the original asset programme by more than 100% on guardrails (460%) and drainage (148%). Further detail can be found in our interactive dashboard.

National Highways has reported that two cyclical renewal types were under-delivered in the reporting year: bridge joints (by 28%) and bridge bearings (by 37%). The company reported that the primary driver for under-delivery of bridge joints was due to the deferral to Year 5 of the M6 Junction 9 Bescot Viaduct scheme, to allow the completion of the M6 Junction 10 enhancement project and minimise the impact on customer journeys. The company’s under-delivery of bridge bearings was due to the A27 Adur Viaduct scheme being delayed due to workforce constraints and inclement weather.

Figure 4.1 Volumes of major life-extension renewals greater than planned between April 2023 and March 2024

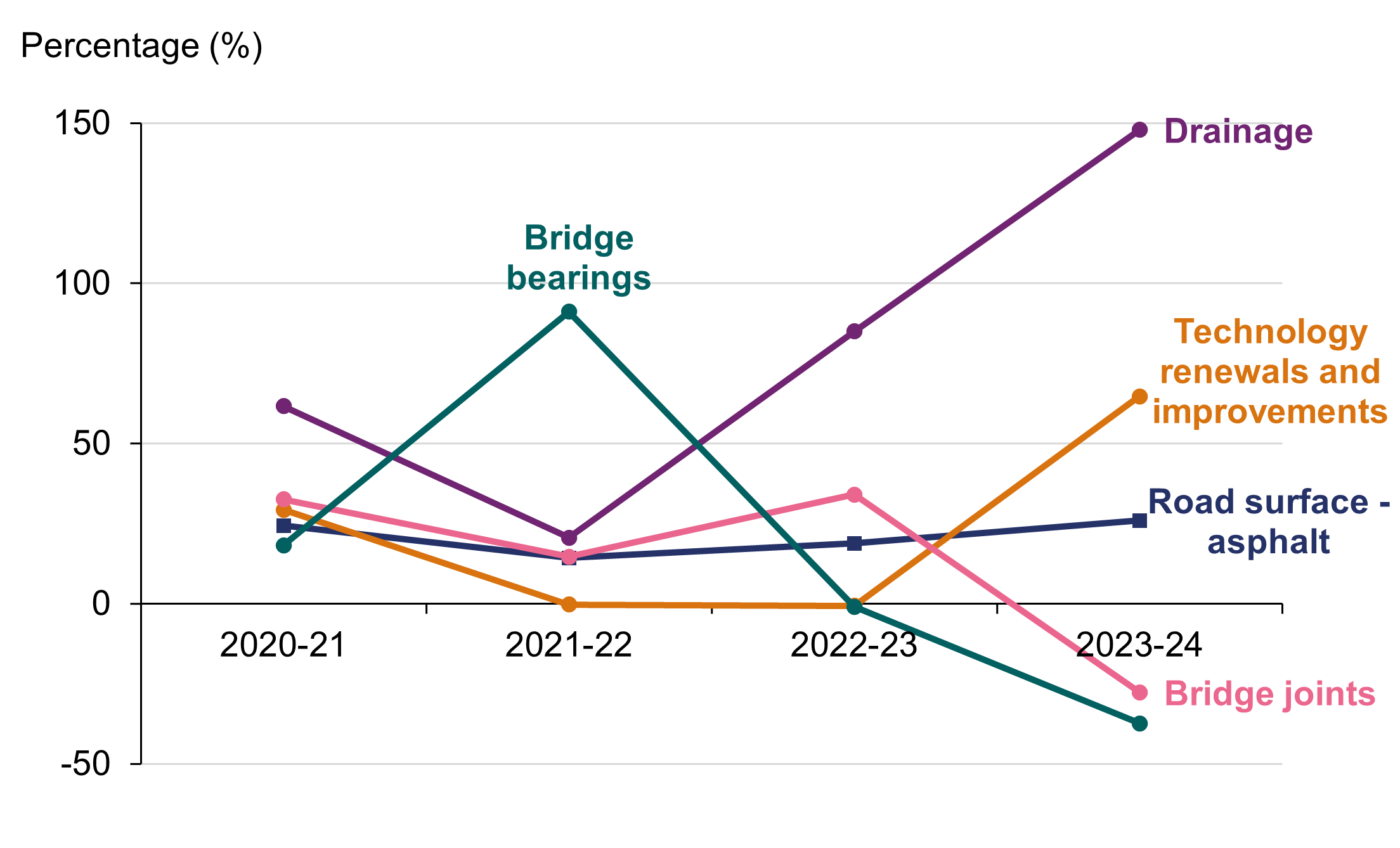

In our last annual assessment, we reported that over-delivery against its original plan may provide an indication that National Highways’ planning abilities are limited, as the company was unable to evidence the cause of the increases. This appears to have been reaffirmed this year as over delivery of renewals volumes has continued without robust evidence as to the cause.

National Highways’ over-delivery of its original programme has primarily occurred during the fourth quarter of each RP2 year, resulting in a sharp increase in delivery of volume. Whilst the company indicated that the primary driver for over-delivery in the reporting year was due to an increase in renewals funding, it was unable to demonstrate how many additional renewals were delivered solely because of the revised budget. This indicates a need to mature its approach to controlling programme change to enable a fully transparent approach to tracking investment.

Figure 4.2 shows how National Highways has delivered against its plan in RP2 to date. The consistent divergence indicates that the company’s original plans are not suitable, and therefore it is potentially investing inefficiently in its asset portfolio.

Figure 4.2 Variance of volumes of renewals delivery compared to plan for a selection of assets, April 2020 and March 2024

National Highways’ renewals plans do not appear to accurately align to the requirements of its performance targets. The company’s 2020-2025 delivery plan includes key performance indicator (KPI) targets for pavement condition and an untargeted performance indicator (PI) for drainage resilience.

In Year 4, National Highways over-delivered on road surface (pavement) asphalt, drainage and technology renewals against its plans by 26.0%, 147.9% and 64.7%, respectively. Whilst pavement renewals delivery in-year exceeded its plan, the KPI outcome remained uncertain and was only just achieved. Similarly, drainage resilience performance has continued to decline even when there has been significant over-delivery.

In Year 5, the company has a challenging concrete barrier programme that it must deliver. National Highways’ 2020-2025 delivery plan states a commitment to deliver 50 miles (80 km) of concrete safety barriers (also known as vehicle restraint systems). To date, the largest in-year delivery the company has achieved is 9 miles (14 km). Therefore, to meet its commitment the company will need to deliver a total of 25 miles (41 km) in the final year of the second road period, 50% of its commitment. The company must provide assurance that it is able to deliver its plan. We will engage with it to understand its capacity and capability and ultimately hold it to account to meet this commitment.

National Highways needs to mature its ability to accurately plan its renewals programme and improve its alignment to achieve its RIS2 commitments and targets. The company should seek to avoid large in-year variations in its renewals programmes and to better evidence the reason for any large in-year changes. We will continue to hold the company to account against its delivery plan to achieve the required performance. This will include further monitoring of in-year (monthly and quarterly) plans and will require better evidence of delivery against them.

Asset management strategy implementation

In our last annual assessment, we reported that National Highways produced a new asset renewals reporting tool: the Capital Delivery Management Tool (CDMT). The company uses this tool to collate and report data about its assets in ways it was previously unable to. In particular to help it to demonstrate implementation of its asset management strategy and compliance with its licence.

At the end of Year 4, National Highways used CDMT to produce a national report that showed renewals scheme delivery, including changes made during the year. It reported that the cumulative outturn value of its renewals programme had increased by 24.1% over Year 4.

Reasons for changes to the renewals programme include:

- 105 changes at a value of £22 million due to change in asset need; and

- 28 changes at a value of £15 million due to increased programming to meet delivery plan outputs.

This is a positive demonstration of National Highways’ ability to actively amend its programme to consider asset need throughout the year. The report also provides greater transparency of the implementation of its asset management strategy.

The reporting highlights areas where National Highways needs to improve the implementation of its strategy. The company reported:

- 387 changes at a value of £91 million due to changes in project scope;

- 322 changes at a value of £61 million where the scheme completion is delayed beyond the reporting year; and

- 46 changes at a value of £27 million were categorised as ‘Other’.

This magnitude of change and National Highways’ inability to disaggregate the causes of change in sufficient detail demonstrates that the company is not able to deliver its renewals programme as originally intended and appropriately evidence why. The company needs to improve its effectiveness in implementing its asset management strategy. We would expect this to reduce the number of in-year changes to the programme and improve disaggregation as to the cause of changes.

In Year 5, we will continue to hold National Highways to account to demonstrate how it is using this information to mature its delivery of its renewals programme to demonstrate implementation of its asset management strategy.

Further detail on National Highways’ renewals programme stability can be found in our interactive dashboard.

Strategic renewals projects

National Highways is managing an ageing network. As a result, it is expected that the company will need to deliver more high value and complex renewal schemes, such as large structures and concrete roads renewals. This can have a disruptive impact on customers.

In preparedness, we asked National Highways to develop robust governance and assurance processes for the end-to-end delivery of these strategic renewals projects that is commensurate with the level of complexity and risk of these schemes.

In response, National Highways has started to develop governance, assurance and ways of working to ensure there is consistency for the delivery of complex renewals. This will be tested in the final year of RP2 to ensure they are ready for implementation in the next road period. We will monitor the progress of this work to understand its benefit and successful governance of large renewals schemes.