National Highways has met its efficiency milestone for Year 4. It is forecasting that it will meet its target for the end of the second road period (RP2), although there is some risk around this, with around a third of the efficiency to be delivered in the final year. The company has been affected by significantly higher than expected inflation during RP2. It has taken account of this in both its reported efficiency improvements to the end of Year 4 and its forecast for RP2 as a whole.

National Highways has improved the quality of the evidence supporting its efficiency reporting during Year 4. The company has responded positively to areas we highlighted for improvement in our last annual assessment. Further development is still required in some areas, both in the shorter-term (for the end of RP2) and the longer-term.

Throughout the reporting year, National Highways has been required to manage significant uncertainty and financial pressure. At the end of Year 4, there were a number of decisions relating to National Highways’ funding and deliverables for the final year of RP2 progressing through the formal change control process. The timing of the General Election meant that the government was unable to complete the process. Decisions were therefore not finalised at the time of writing.

Whilst funding for Year 5 has not yet been confirmed by government, National Highways is expecting, and has developed a proposal, to manage an overall funding reduction of £919 million. As a result of this reduction, the company, at the end of March 2024, was forecasting £319 million of underfunding. It needs government to make decisions to provide certainty on the portfolio, the funding available, and efficiency requirements in the last year of RP2 if it is to deliver successfully and prepare for the next road period.

Efficiency

National Highways has met its cumulative efficiency milestone for Year 4 of £1,220 million and reports that it expects to deliver the key performance indicator (KPI) for RP2. ORR highlighted risks to delivery of the KPI in our Annual Assessment for April 2022 to March 2023 and the company has taken steps to mitigate some of these, for example through reporting improvements. Whilst the company’s ability to better forecast efficiency performance has improved, it must ensure that it remains focused on managing efficiency risk in the final year of RP2 and that it is able to act accordingly.

KPI: Total Efficiency

National Highways has a RIS2 KPI target to deliver £2,111 million of capital or operational efficiency during RP2. We expect the company to propose a change to the target to reflect the impact of any potential funding and output changes made to the RIS, subject to government decision.

National Highways’ reported efficiency over the first four years of RP2

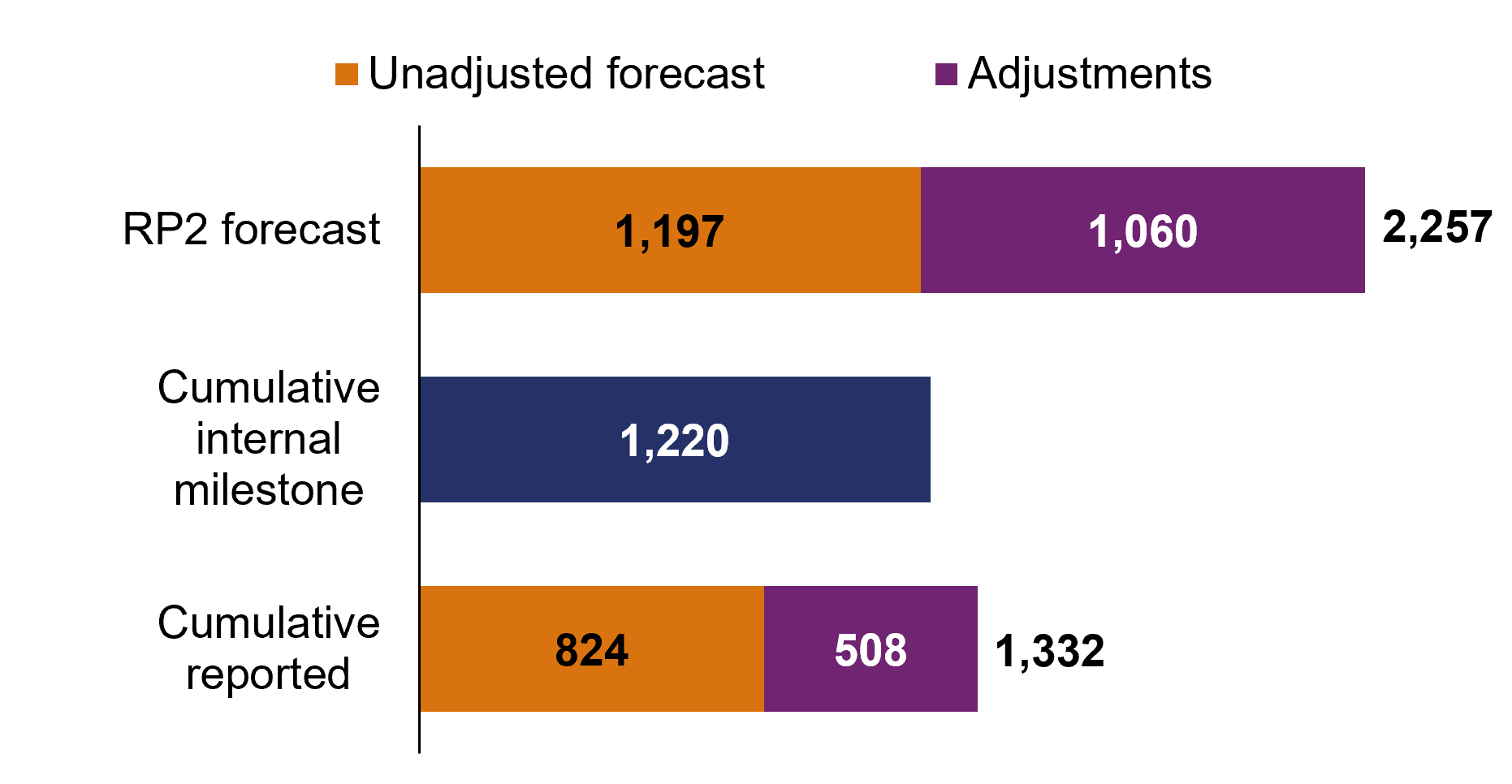

Figure 5.1 shows that National Highways reported cumulative efficiency of £1,332 million to March 2024. This includes an adjustment of £523 million for inflation being higher than originally estimated for its funding, offset by £15 million of other adjustments (discussed below). The company has delivered £112 million efficiency more than its internal milestone to the end of March 2024 of £1,220 million.

Figure 5.1 Cumulative reported efficiency against milestone and forecast (£ million), March 2024

Assessment of in-year efficiency evidence

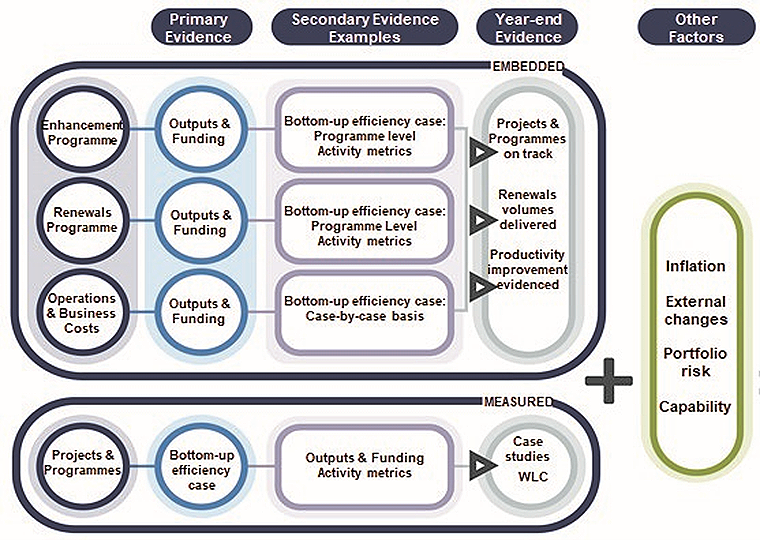

ORR has an important monitoring role to evaluate the quality of efficiency evidence provided by National Highways. Figure 5.2 shows the different types of efficiency and the supporting primary and secondary evidence the company presents to support the reported values. The company’s Year 3 Efficiency Report provides definitions of types of efficiency used in this chapter. The Year 4 Efficiency Report, due to be published this autumn, summarises the evidence for its reported efficiency in Year 4.

Figure 5.2 Sources of evidence for types of efficiency by expenditure category

Assessment of cumulative efficiency evidence in the reporting year

Tables 5.1 and 5.2 show how National Highways’ reported cumulative efficiency is broken down against different categories. They also present ORR’s assessment of the evidence supporting each category, on which we provide more detail below.

Table 5.1 Embedded efficiency reported and our assessment of supporting evidence

| Embedded efficiency | Reported cumulative (£802 million) | Primary: outputs and funding | Secondary: activity metrics | Secondary: case studies |

|---|---|---|---|---|

| Capital enhancements | -£30 million | Good evidence | Good evidence | Good evidence |

| Capital renewals | £294 million | Good evidence | Good evidence | Good evidence |

| Operations and business costs (capital) | £148 million | Good evidence | Not available | Developing evidence |

| Operations and business costs (operational) | £389 million | Good evidence | Not available | Good evidence |

Table 5.2 Measured efficiency reported and our assessment of supporting evidence

| Measured efficiency | Reported cumulative (£530 million) | Primary: case studies | Secondary: outputs and funding | Secondary: activity metrics |

|---|---|---|---|---|

| Carry-over | £302 million | Good evidence | Not applicable | Not applicable |

| RP2 generated | £228 million | Good evidence | Developing evidence | Developing evidence |

Efficiency evidence – outputs for funding

In response to challenge from ORR, National Highways has made improvements to its primary evidence for embedded efficiency. The period of high inflation has had a significant impact on the company’s costs and £523 million (39%) of its reported efficiency relates to a ‘headwind’ adjustment to ensure efficiency performance fairly accounts for the impact. We reviewed and agreed the basis of the adjustment in Year 3. In this reporting year a much smaller adjustment was agreed to reflect the cost impact of a change in treatment of VAT.

In the last year, National Highways has improved its renewals efficiency reporting to reflect where it has over or under-delivered originally planned outputs and the depth of its pavement renewals which affects longevity. Overall, our assessment of the company’s primary evidence for embedded efficiency shows that it has broadly delivered outputs within its funding after adjusting for inflation and VAT treatment changes affecting its costs.

National Highways provided financial data related to the Tier 1 enhancement schemes included in the measured RP2 generated efficiency category to support our assessment of delivering the outputs for funding as a form of secondary evidence. This shows good progress since the previous year, and we will continue to work with the company to assess how the evidence in this area continues to mature to the end of the road period.

Efficiency evidence – activity metrics

National Highways’ efficiency evidence derived from activity metrics for enhancements and renewals has increased in scope. As at March 2024 it showed good supporting evidence of efficiency.

During the reporting year, National Highways explored with us options for activity metrics to be utilised as secondary evidence for both operational and capital operations and business costs. While the company is open to developing more metrics in the future, at this time it deemed the metrics unsuitable in these areas. This was due to complexities in correlating the potential metrics with efficiency performance. We welcome the engagement the company displayed in exploring these options and its openness to developing these metrics in future road periods.

National Highways undertook a pilot in the reporting year to explore how existing activity metrics could be applied to the enhancement schemes that fall within the scope of the RP2 generated category. Results from this were positive and we will work with the company in the final year of the road period to extend the pilot to cover all schemes within the RP2 generated category.

Efficiency evidence – efficiency case-studies

National Highways continued to report case studies (descriptions of efficiency initiatives and financial benefits) for RP2 generated measured efficiency and across all categories of embedded efficiency. These case studies represent the gross value of a wide range of efficiency initiatives delivered by the company in RP2, rather than the net efficiency position. In some instances, the value of secondary evidence presented continued to be below the reported primary embedded efficiency. This is an area where National Highways needs to improve going forward. The company continued to submit case studies for our review throughout the reporting year and responded positively to challenge.

National Highways’ £302 million carry-over efficiency is supported by case studies that we reviewed during RP1. The company applies earned value principles to identify the value, or proportion, of the efficiencies in those case studies that it claims during RP2.

National Highways’ forecast efficiency against its KPI target

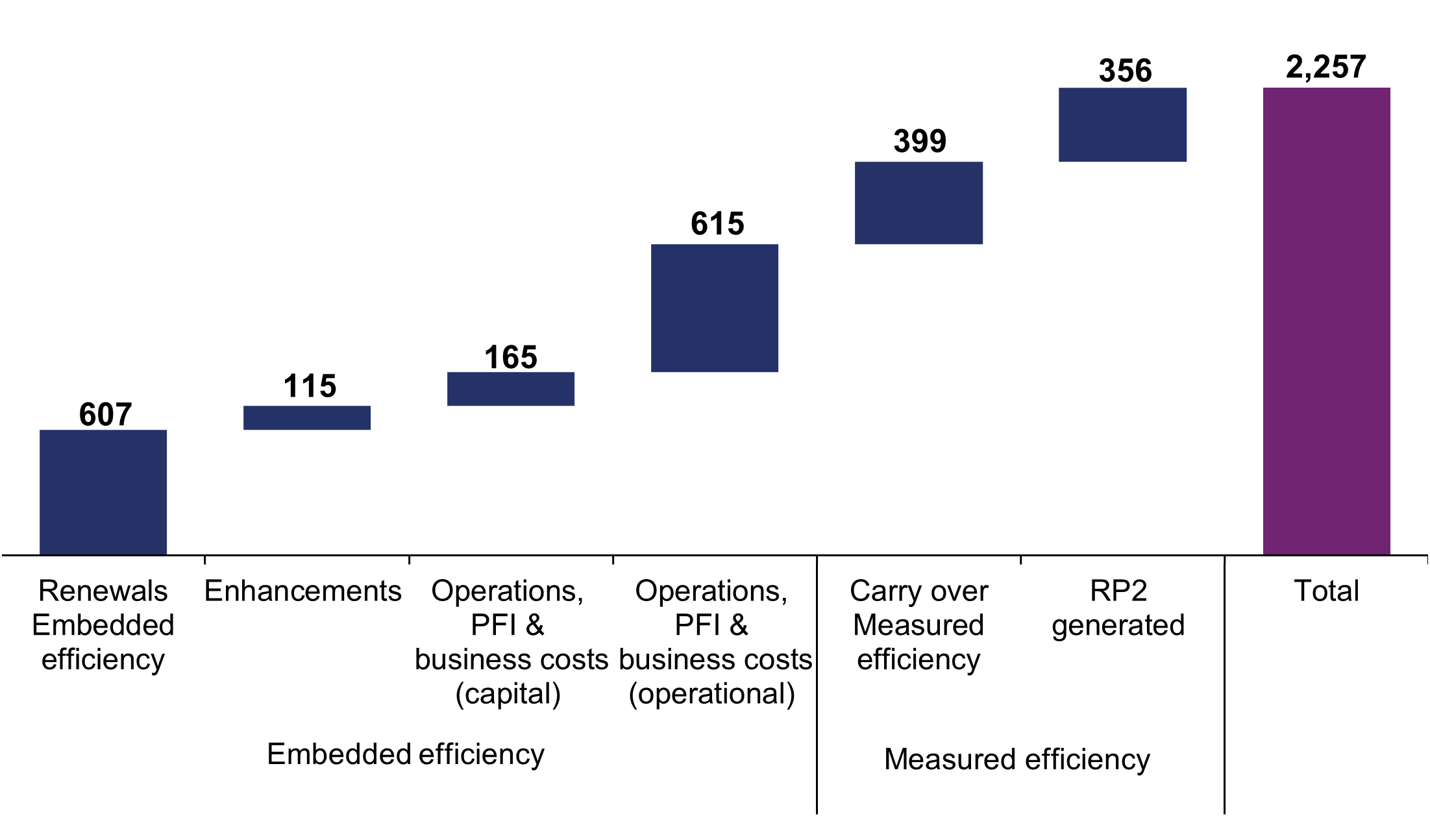

National Highways is forecasting to deliver £2,257 million of efficiency in RP2 (assuming the potential funding change is agreed by government), as shown in Figure 5.3. The forecast position includes adjustments for the impact of excess inflation on reported efficiency as well as delivering additional renewals outputs, pavement renewal depth and the external impact of a change to the treatment of VAT.

Figure 5.3 Reported RP2 forecast efficiency (£ million), March 2024

Assessment of efficiency evidence RP2 forecast

In ORR’s Annual Assessment of National Highways’ performance for April 2022 to March 2023 we identified that there were several areas of uncertainty affecting its forecast efficiency performance. The progress the company has made, with ORR and DfT, in considering a revised efficiency target (pending government decision) linked to the expected funding change has reduced the uncertainty in the forecast. The company has also responded positively to ORR highlighting a need for reporting improvements in some areas by making changes during the year.

During the year we worked with Rebel Group consultants to review National Highways’ proposed approach and (current) value of efficiency adjustments for two new ‘headwind’ cost impacts outside of the company’s control (for the impacts of Coronavirus and changes to the treatment of VAT) and differences in renewals outputs compared with RIS2 assumptions. On headwinds, the review was limited by the company’s proposals being at an earlier stage than previously indicated. The consultants found that its case for a potential adjustment for the pandemic was under-developed. Subsequently, the company decided there was no substantive rationale to take forward a headwind adjustment for the pandemic and so it has not pursued it further.

The consultants reviewed National Highways’ proposal for an efficiency adjustment for the change in the treatment of VAT. It concluded that this was reasonable and the company included this adjustment in its year-end reporting, along with the previously agreed inflation adjustment. The consultants also reviewed and endorsed how the company recognised the efficiency impact of renewing more/less key assets and greater asphalt pavement depth than assumed in RIS2.

While National Highways has improved the evidence for efficiency delivered to date, which also helps ensure its RP2 forecast is more robust, there are some notable risks remaining. These include the potential impact of headwinds including Year 5 inflation, cost risks from delays to enhancement commitments, performance risks on several KPIs and clarity around potential funding constraints which could result in a pressure the company needs to manage (discussed below). These risks are further exacerbated as the company’s planned delivery of efficiency is heavily back end loaded towards the final years of RP2, predominantly a consequence of the enhancement delivery profile. This means it has yet to deliver one third of the efficiency required to meet its target and must stay focused to the very end of the road period.

Overall, the RP2 efficiency forecast has improved in the last year and there is also more certainty in the forecast than in March 2023. However, to ensure planned efficiency improvements are delivered, National Highways must continue to focus on managing remaining risks in the final year of RP2. It is also vital that government gives the company clarity over proposed changes to RIS2, including the efficiency KPI, as this uncertainty adds additional risk to achieving the target.

Financial Performance

At the end of Year 4, there were a number of decisions relating to National Highways’ funding and deliverables for the final year of RP2 progressing through the formal change control process. The timing of the General Election meant the government was unable to complete the process. Decisions were not finalised at the time of writing and therefore we are reporting the position the company reported to us at the end of Year 4.

Funding for Year 5 is yet to be confirmed by government as decisions have been paused due to the General Election. However, National Highways has managed its expenditure in Year 4 in anticipation of a £919 million gap between the statement of funds available (SoFA) for RIS2 and the funding available in DfT business plans for Years 4 and 5. The company is projecting to overspend its RIS2 funding and may need to make further changes to its programme in the final year of RP2.

As discussed in chapter 3, despite now delivering fewer schemes, the total cost of completing National Highways’ enhancements portfolio in this and future road periods has increased to £29,932 million from a baseline position of £23,643 million in April 2020. The higher than funded inflation and delays in schemes during RP2 have significantly contributed to the increase but do not account for all increases to the programme.

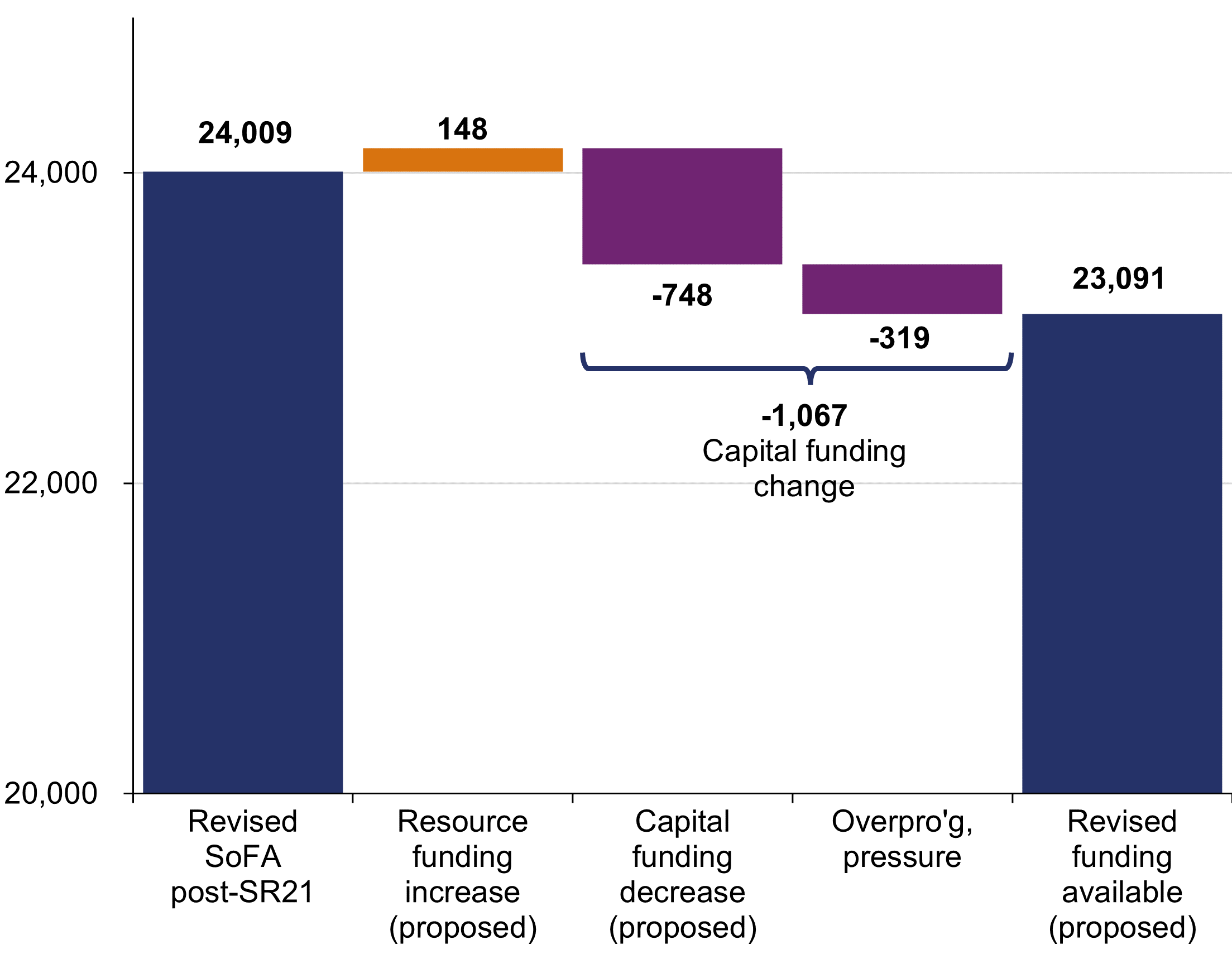

Overview of proposed funding changes for RIS2

National Highways has already reflected the expected funding changes (to be confirmed by government), in its reporting to us in quarter three and quarter four of this year, to account for the difference between the available funding and the SoFA. As shown in Figure 5.4, within the total net reduction, resource funding increases by £148 million, predominantly to respond to inflationary pressures. Counter to this, RP2 capital funding has a net reduction of £1,067 million. Subject to agreement, the company is proposing to manage the net change to its capital funding across its portfolio.

Figure 5.4 Change in funding proposed during Year 4 subject to government approval (£ million), March 2024

Within the overall planned funding reduction, in March 2024, National Highways forecasted it would need to manage a pressure of £319 million in the final year of RP2. Delays in enhancement planning approvals, including decisions by government and subsequent legal challenge, have pushed cost into later years. This created an underspend in Year 4, which was expected to help cost pressures in the final year. However, constraints on funding available in Year 5 mean some of the unused funding from Year 4 is not available for Year 5.

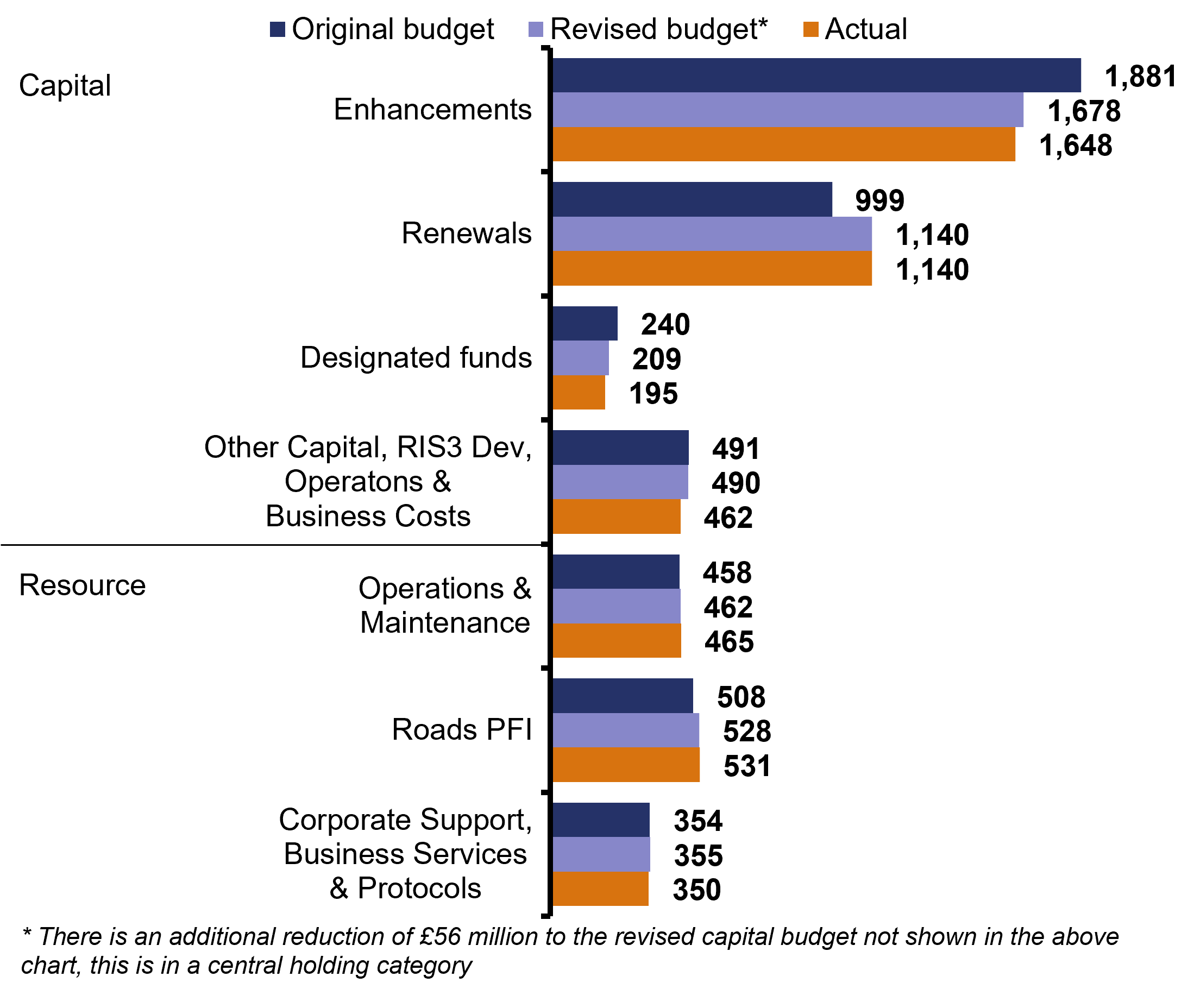

April 2023 to March 2024 budget and expenditure

In Year 4, National Highways’ original budget (capital and resource) was £4,931 million which it revised down to £4,806 million in the autumn as a result of legal challenges to planning decisions and delays in government decisions. The company expected £150 million of unused capital funding (which it notified DfT about in autumn 2023) to be carried forward to Year 5 as had been the case in previous years. However, DfT budget constraints has resulted in the £150 million being part of the funding reduction (without a change in outputs) and contributes to the cost pressure National Highways is expected to manage in Year 5.

National Highways spent in-line with its revised resource budget of £1,345 million and spent £3,445 million against its revised capital budget of £3,461 million, an underspend of £16 million (0.5%). A breakdown of expenditure against budget is shown in in Figure 5.5.

Figure 5.5 Capital and resource expenditure against budget April 2023 to March 2024 (£ million rounded)

Capital Expenditure

Enhancements and Renewals

When creating its revised budget for Year 4, National Highways managed the reduction of £150 million across a number of budget areas. For example, it reduced the enhancements budget by £203 million, which it offset in part with a £141 million increase in the renewals budget. The company was able to reduce its enhancements budget as there were delivery challenges for schemes with Development Consent Order (DCO) related schedule slippage. This was, in part, repurposed for renewals to help meet cost increases from inflationary pressure.

National Highways reported a small underspend of £30 million (1.8%) in Year 4 against the revised budget for enhancements and reported actual spend in-line with its revised renewals budget of £1,140 million.

Designated funds

National Highways’ original Year 4 budget for Designated Funds was £240 million, which it later reduced to £209 million. The company’s final spend for Year 4 against this budget was £195 million, a £14 million (6.7%) underspend. The underspend against its revised budget occurred across three funds: Innovation and Modernisation (£2 million), Safety and Congestion (£2.7 million) and Users and Communities (£9.5 million). Only the Environment and Wellbeing fund exceeded its revised budget (by £0.3 million). The company has reported to us that the underspend was because of projects funded by designated funds slipping into the final year of the road period.

Resource Expenditure

The initial resource budget for Year 4 included a £100 million increase concurrent with a £100m decrease in the capital budget. During the year, the company increased its resource budget by an additional £25 million as part of the in-year revisions, alongside the decrease to capital budgets. The total £125 million increase to the resource budget was to cover inflationary pressures and to support the originally unfunded Operation Brock. All categories of resource expenditure ended the year with no more than a £4 million variance against the revised funding levels.

RP2 capital expenditure forecast

At the end of Year 4, there were a number of decisions relating to National Highways’ funding and deliverables for the final year of RP2 progressing through the formal change control process. The timing of the General Election meant the government was unable to complete the process. Decisions were not finalised at the time of writing and therefore we are reporting the position the company reported to us at the end of Year 4.

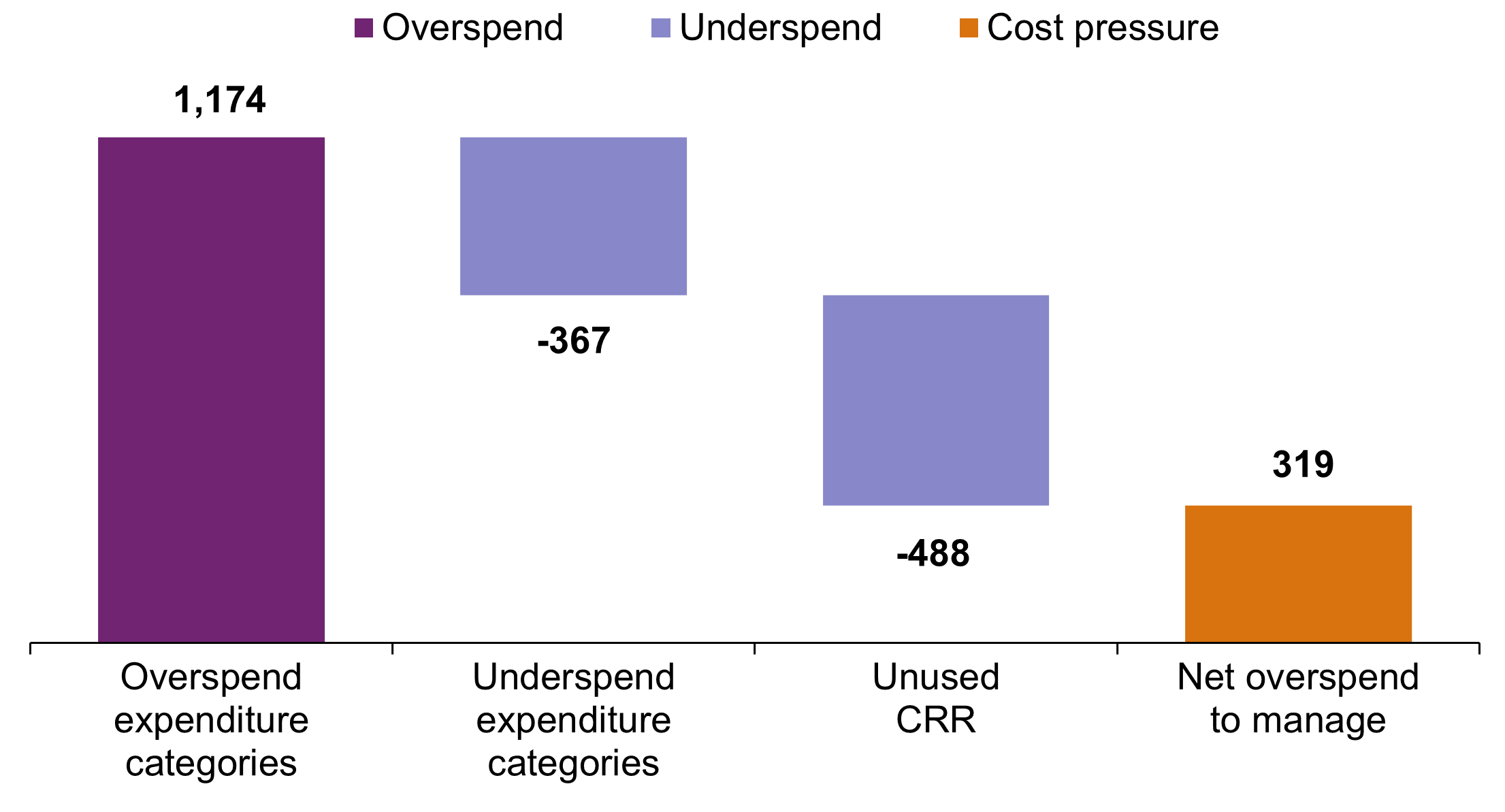

At the end of March 2024, National Highways was forecasting to spend £17,194 million across RP2 against its capital funding allocation of £16,875 million, assuming full use of the remaining central risk reserve (CRR). This would result in an overspend of £319 million, if realised, as shown in Figure 5.6.

Figure 5.6 RP2 capital forecast variance summary (£ million), March 2024

In March 2024, National Highways was forecasting a £1,174 million overspend on enhancements, renewals (due to inflation and concrete roads scope increases) and business costs (due to additional expenditure on digital services). However, the net impact of enhancements and renewals overspends would be reduced if unused CRR is applied in Year 5 as the company expects (see below). There was also a forecast underspend on designated funds (due to challenges in programme delivery and the impact of anticipated reduced funding) and RIS3 preparation and development (due to changes to schemes announced in the written ministerial statement of 9 March 2023).

National Highways has currently assigned the £1,067 million expected capital funding reduction (subject to approval by government) shown in figure 5.4 against its enhancements funding line whilst the company awaits final confirmation of funding from government. Should the funding reduction be confirmed, subject to agreement, it is expecting to manage it across its capital portfolio. As of March 2024, the company was forecasting £319 million underfunding in Year 5 it would need to manage as part of this.

We have challenged National Highways on how it would manage the forecast cost pressure of £319 million in Year 5 if realised. It has indicated that some schemes are at risk of planning delays in Year 5, which would move cost from the final year of RP2 in to the first year of RP3, and therefore would reduce the cost pressure in period.

The company is continuing to work with DfT to develop and finalise plans for how it will manage funding reductions in Year 5 and to understand the impact on delivery and performance.

Central risk reserve

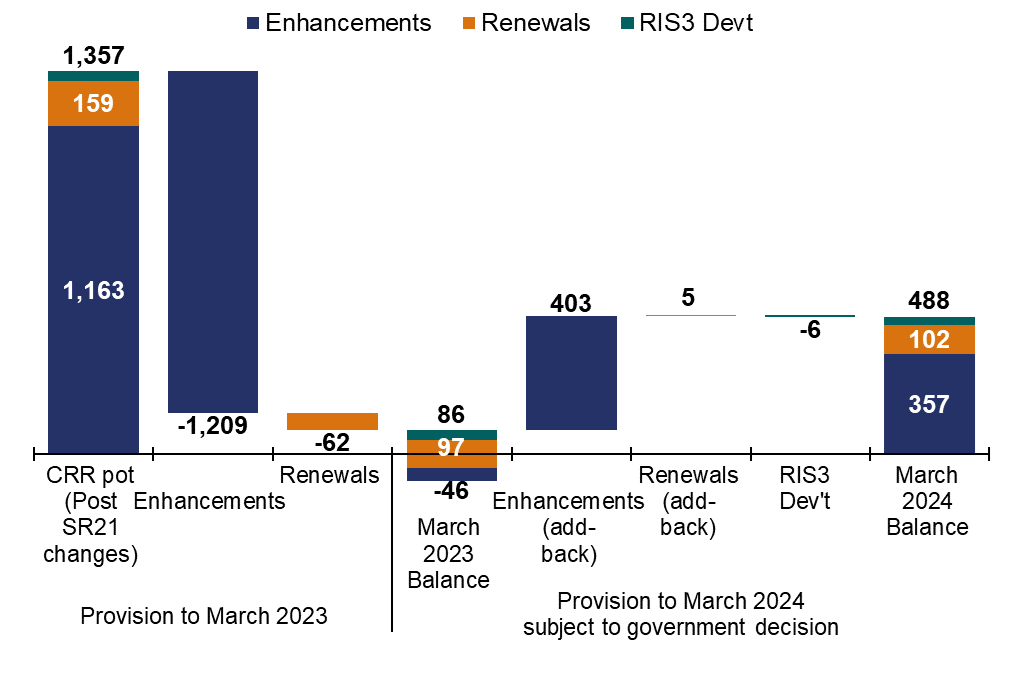

Figure 5.7 shows the evolution of allocation of the central risk reserve (CRR). Following the 2021 Spending Review, the CRR was reset to £1,357 million. In March 2023, National Highways had just £86 million CRR remaining unallocated due to making provision for significant enhancement cost risk in the early part of RP2. However, as predicted in our last annual assessment, agreed scheme changes in Year 3 and anticipated changes in Year 4, that are pending government decisions, meant the company was able to release £403 million back to the CRR pot for reallocation. There was also a small add-back from renewals CRR reduction, but this has been offset by an increased allocation for RIS3 Development to support options assessment for significant structures work for the next road period.

National Highways needs government to confirm funding and the commitments it is required to deliver in the final year of RP2, as decisions were paused due to the General Election, so that it can allocate CRR accordingly. In March 2024, the enhancements changes (that are pending government decisions) meant National Highways held £488 million of its CRR unallocated to schemes or other budgets within the business. However, based on the risks and funding constraints that the company anticipates in the final year of RP2, it expects to use all of the remaining CRR.

Figure 5.7 Funding changes and use of CRR provision since April 2020 (£ million), March 2024