In Year 4 of the second road period (RP2), National Highways successfully opened for traffic four enhancements schemes and started work on one. The total number of missed enhancements commitments has increased by four: three in Year 4 and one from Year 5, taking the total to 11 for RP2.

The company has stated that the reasons for the increase in missed commitments are primarily supply chain management and asset data. National Highways needs to provide further specific and measurable details to evidence how it is implementing improvements to manage and mitigate its identified risks so that it can successfully deliver the remaining portfolio.

National Highways has a commitment to install 151 additional Emergency Areas (EAs) to improve public confidence that there is safe place to stop in an emergency on all lane running (ALR) sections of the smart motorway network. The programme is heavily loaded towards the last quarter of Year 5. The programme has limited schedule float and there are a variety of construction complexities that the company needs to manage. We expect National Highways to continue to actively engage with us to demonstrate that risks to the programme are raised early to maximise its ability to mitigate and successfully deliver its Year 5 programme.

National Highways has had to manage uncertainty in its enhancement portfolio in RP2. In Year 4, a number of decisions relating to the company’s funding and portfolio were progressing through the formal change control process at the time that the General Election was called. Decisions were therefore not finalised at the time of writing. To allow the company the ability to successfully deliver its enhancements portfolio, and determine the impact on users and stakeholders, it needs certainty as to the commitments it is required develop and deliver in Year 5 of RP2.

Road Period 2 overview

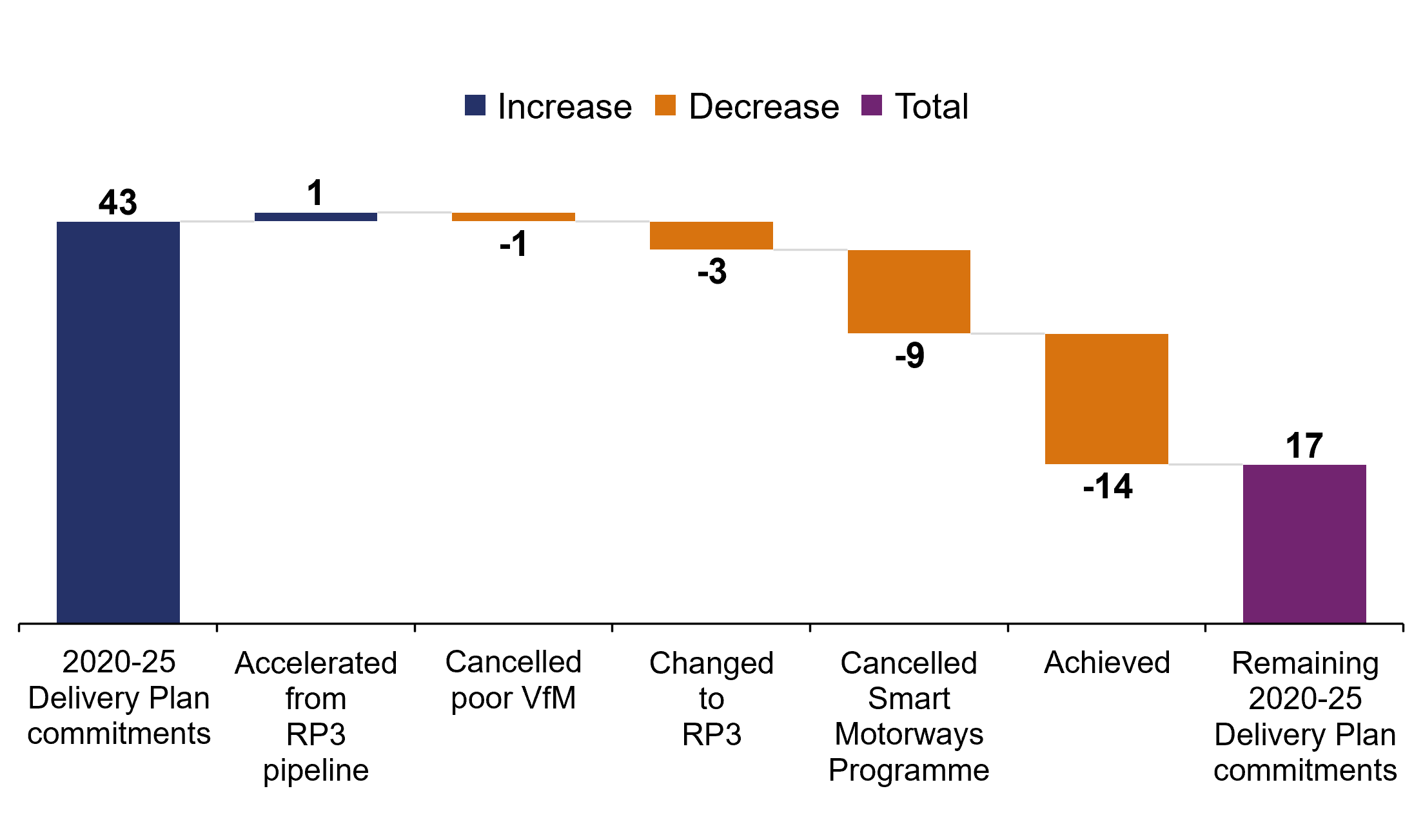

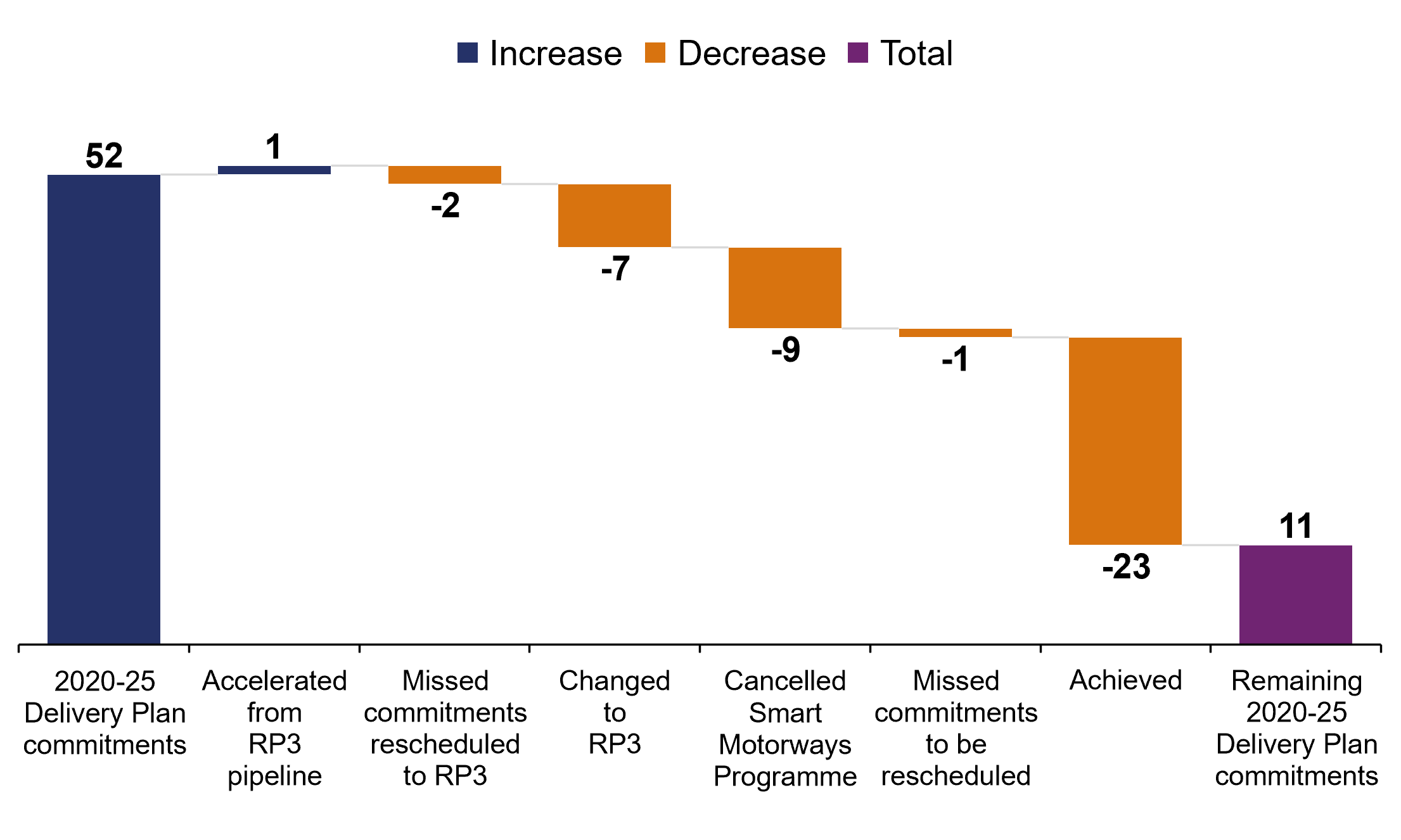

At the start of RP2, National Highways committed in its 2020-2025 delivery plan to 43 start of works (SOW) and 52 open for traffic (OFT) enhancements scheme commitments as part of the second road investment strategy (RIS2). This has reduced across RP2 due to government agreed changes that are outside of National Highways’ control, as shown in Figure 3.1 and Figure 3.2.

Figure 3.1 2020-25 Delivery Plan SOW commitments remaining at the end of Year 4 of RP2

Figure 3.2 2020-25 Delivery Plan OFT commitments remaining at the end of Year 4 of RP2

The remaining Delivery Plan 2020-25 commitments, subject to confirmation in National Highways' Delivery Plan 2024-25, are:

- 17 SOW commitments; and

- 11 OFT commitments.

Further detail can be found in our interactive dashboard.

Year 4 of RP2

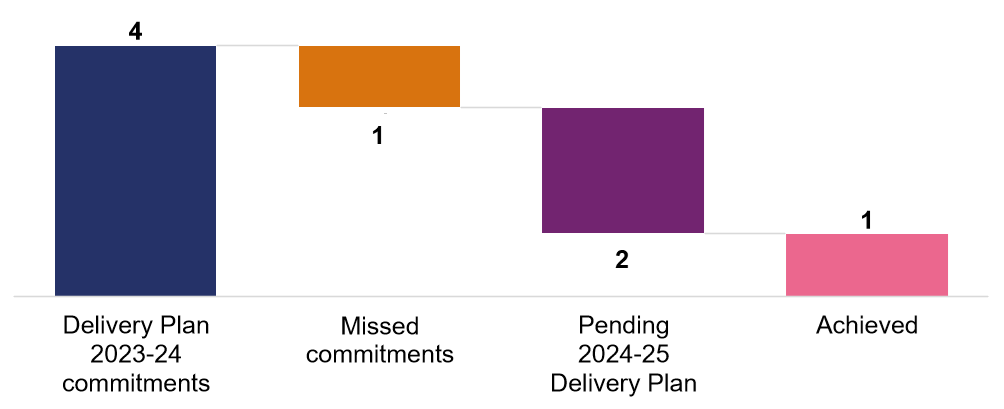

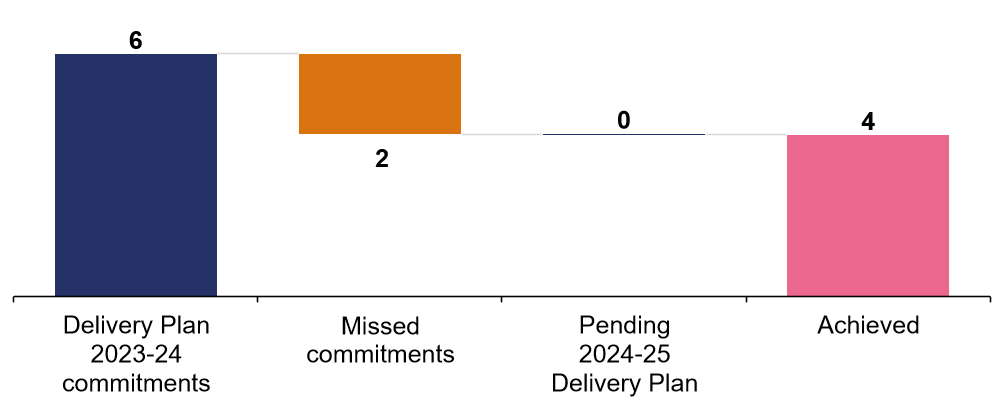

National Highways’ 2023-2024 delivery plan committed the company to achieve four SOW and six OFT commitments in the fourth year of RP2. National Highways’ progress in delivering its Year 4 commitments is set out in Figure 3.3 and Figure 3.4, where the status of each commitment is shown.

At the end of Year 4, there were several decisions relating to National Highways’ funding and deliverables for the final year of RP2 progressing through the formal change control process. As a result of the General Election the government was unable to complete the process. Decisions were therefore not finalised at the time of writing. It is expected that these decisions will be confirmed in National Highways Delivery Plan Update 2024-25.

Figure 3.3 SOW delivery for the reporting year April 2023 to March 2024

Figure 3.4 OFT delivery for the reporting year April 2023 to March 2024

Further detail of each scheme and its status can be found in our interactive dashboard.

Commitment changes

It is sometimes necessary, as schemes progress, that changes to the originally agreed programme are needed. Commitment changes, which must be agreed with government, either result in a change to SOW and/or OFT committed dates, or the number of commitments to be delivered during RP2.

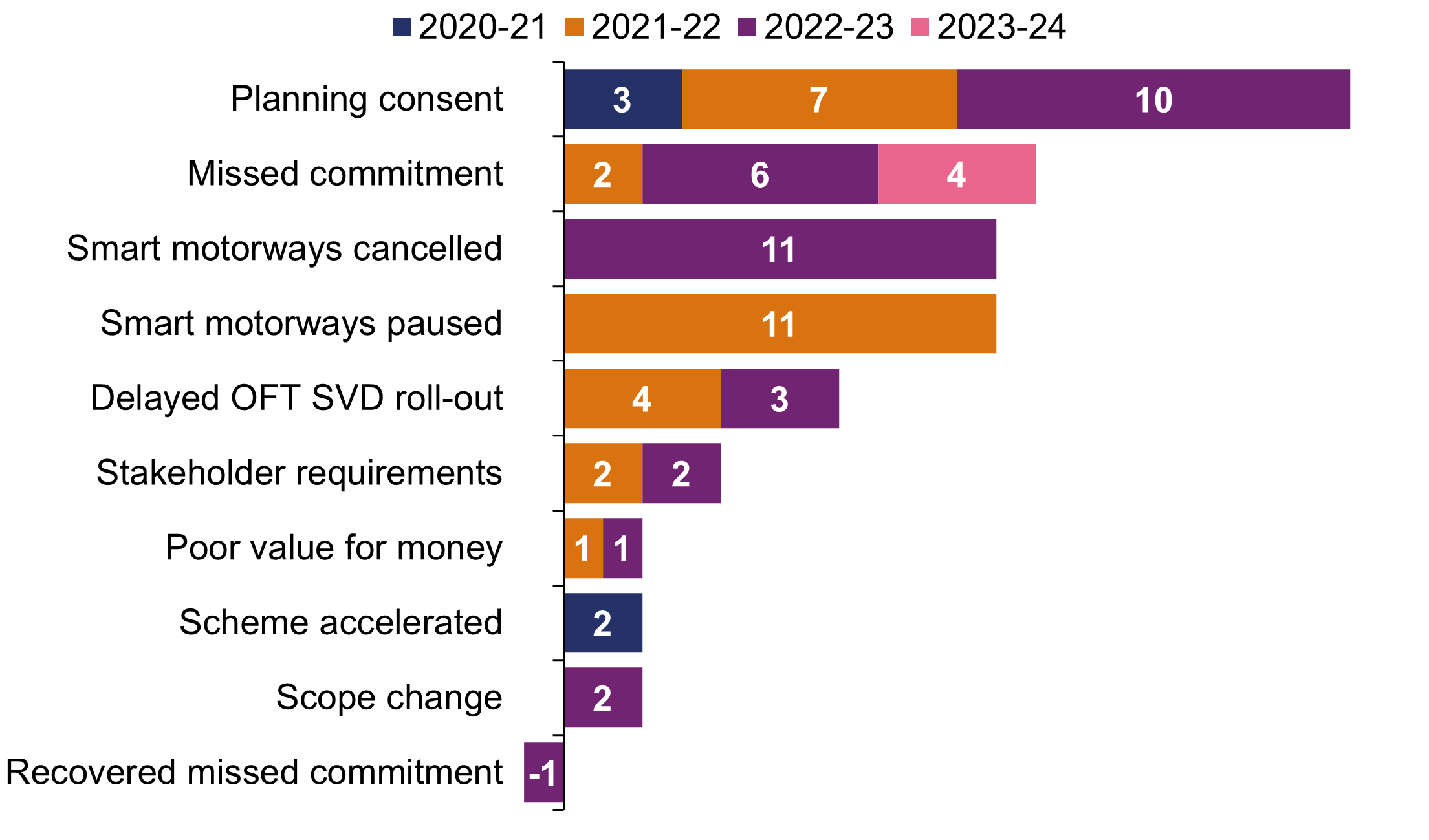

In the second road period, there has been a total of 59 government agreed changes to the enhancements capital portfolio. As a result of these changes, 12 commitments have moved into RP3. Therefore, there are fewer enhancements commitments to be achieved in RP2 than originally anticipated at the start of the road period. Figure 3.5 shows the reasons for commitment changes in the second road period, and further detail can be found in our interactive dashboard.

Figure 3.5 Government agreed changes and National Highways missed commitments to 2020-25 Delivery Plan schemes by reason, annual data, April 2020 to March 2024

Missed commitments

If a change or delay to the delivery of RIS2 or delivery plan commitments is deemed to be primarily a result of something within National Highways’ control, the change is classed as a missed commitment. In Year 4, National Highways has missed three commitments. The company has also declared that it will miss a commitment that was due in Year 5.

This increases the total number of missed commitments for RP2 to 11, more than the first road period, when it missed five of its enhancements commitments.

As the number of missed commitments continues to increase, we are concerned that the company is not suitably effective in mitigating its delivery risks. At the end of Year 3, we asked the company to detail the reasons for each missed commitment and analyse the root causes. The company identified two key themes responsible for missed commitments, namely, supply chain management and asset data.

Throughout Year 4, we worked with National Highways to review the evidence and document why the in-year commitments were not achieved. Whilst there has been some progress in a high-level approach to improving these areas, we have not seen evidence of this realising delivery improvements at an individual scheme level.

In Year 5, we expect National Highways to provide further specific and measurable details to evidence how it is implementing improvements to manage and mitigate its identified risks to further missed commitments in its enhancement programme.

National Emergency Area Retrofit (NEAR) Programme

In November 2021, the Transport Select Committee (TSC) report into smart motorways highlighted the importance of additional Emergency Areas (EAs) in providing public confidence that there is safe place to stop in an emergency on all lane running (ALR) sections of the smart motorway network. It was recommended that National Highways should retrofit EAs to ALR motorways to make them a maximum of one mile apart decreasing to 0.75 miles wherever possible.

As a result, National Highways identified 151 areas out of 400 potential locations that it committed to deliver by the end of RP2.

During Year 4, National Highways provided us with details about the NEAR programme scheduled for RP2. At the end of March 2024, it has completed 13 out of the 151 EAs. The programme is heavily loaded towards the end of RP2, with 117 EAs scheduled for completion during quarter four of Year 5 (this includes 70 EAs in March 2025 with no programme float). National Highways has confirmed that while the programme is challenging, it is managing the risks.

Due to the limited float within the programme and construction complexities of some of the EAs, we have informed the company that we need to have further sight of the progress of the programme and more frequent engagement. These asks have been put in place with National Highways and we will continue to monitor the company’s risk mitigations and programme deliverability throughout the final year of RP2.

RIS2 enhancements financial performance

National Highways has managed its expenditure in Year 4 in anticipation of a £919 million gap between the statement of funds available (SOFA) for RIS2 and the funding available in DfT business plans for Years 4 and 5. The current proposed enhancements funding decrease is larger than anticipated by the company. Options for managing the gap in funding were progressing through the formal change control process at the time of the announcement of the General Election. These decisions have not been finalised and are still pending a resolution.

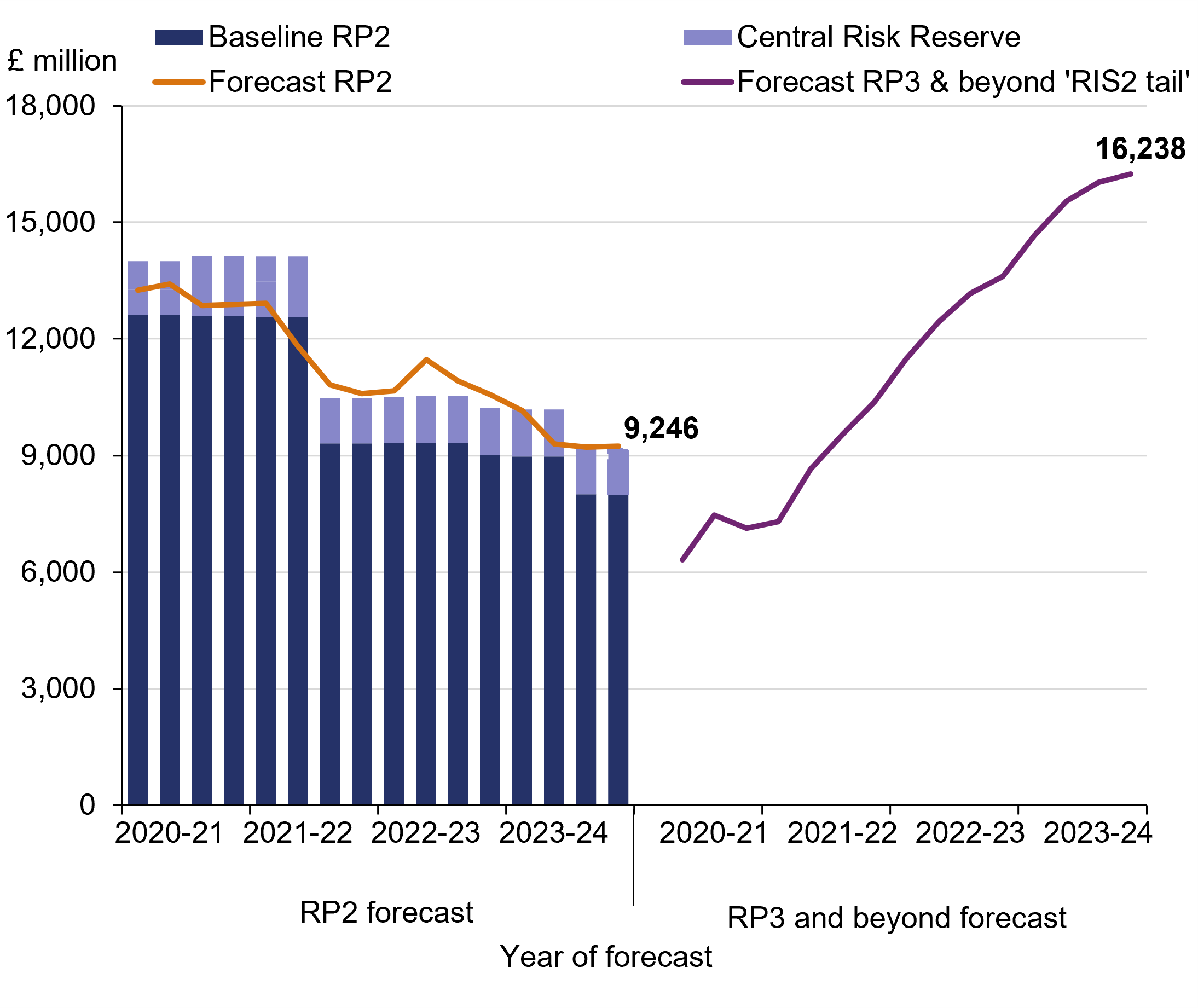

National Highways is currently forecasting to spend £9,246 million on enhancements in RP2 (pending government decision). This is £80 million above the proposed reduced funding allocation for enhancements of £9,166 million (including Central Risk Reserve). The company reported at the end of Year 4 that it has allocated the full capital funding decrease against enhancements. However, subject to agreement, it expects to reallocate the expected funding decrease across other expenditure categories in a new baseline early in Year 5 once funding has been confirmed.

Figure 3.6 Enhancement cost forecasts for RP2 and ‘RP3 and beyond’, quarterly forecast data, April 2020 to March 2024

Figure 3.6 shows that RP2 forecast costs for enhancements have been reducing in RP2 as RIS2 commitments have changed and the government has periodically reduced funding in response. The chart includes, from quarter three in Year 4, National Highways’ reporting of the assumed funding reduction it is expected to manage, pending government decision. The right-hand panel of Figure 3.6 shows that the cost commitments of RIS2 enhancements that will fall in RP3 and beyond (the ‘RIS2 tail’) have increased significantly from £6,315 million to £16,238 million since the start of RP2 because of slippage, inflation and increased scope.

The total forecast outturn cost of RIS2 enhancements (in RP2 and future road periods) is £29,932 million. This has increased by 27% (£6,289 million) since the start of RP2, despite the cancellation of new Smart Motorway schemes in April 2023. The Lower Thames Crossing had the largest forecast cost increase of £2,319 million (39%) to £8,312 million with another large cost increase of £3,289 million (40%) in the Regional Investment Programme.

The impact of higher than predicted inflation and externally caused delays to schemes have significantly contributed to the increase. However, factors within National Highways’ control, including missed commitments, have also been a contributing factor.

As Year 5 begins, it will be important for National Highways and government to address the affordability of the existing enhancements portfolio recognising that it will impact on plans for future road periods. Government needs to confirm early within Year 5 the expected changes to the enhancement portfolio, so the company is confident about what it is required to deliver and ensure its spending is in-line with government’s long-term plans for the SRN.

Use of Central Risk Reserve (CRR) on enhancements

National Highways has a £1,357 million CRR in RP2 for capital portfolio level risks, which includes £1,163 million for enhancements. By the end of Year 3 the company had overallocated its enhancements CRR to schemes meaning it did not have sufficient funding to cover all the identified risk. However, during Year 4, in planning for the potential changes expected to its portfolio, the company has reassessed its use of CRR and has spent or committed £806 million to schemes and other enhancements with £357 million to be reallocated as needed. It expects the CRR to be fully used in Year 5 to assist in closing the potential funding gap, subject to confirmation, which is discussed further in chapter 5. We support the use of remaining CRR to help manage cost and delivery risk in its portfolio for Year 5.

Benefits realisation

In our last annual assessment, we challenged National Highways to put in place a robust benefits realisation programme to understand if it is delivering the outcomes expected from its capital investment efficiently and successfully.

A review, jointly commissioned with National Highways, was completed that assessed and reported on the maturity of benefits management in National Highways against the different RIS2 investment programmes.

The review found that National Highways has a well-established management process for capturing enhancement portfolio benefits. Beyond enhancements the review found inconsistencies in the way benefits management is applied.

In the last year of RP2, and looking towards RP3, National Highways needs to mature its approach for identifying and measuring benefits across its wider functions and activities. This will improve its understanding and evidencing that its investments, beyond enhancements, are understood and realised for road users. We will monitor the company’s progress in developing this capability.

Earned value metrics

Earned value metrics (EVM) are RIS2 performance indicators that measure National Highways’ supply chain performance against contractual cost and schedule commitments during construction. Whilst not a direct reflection of the company’s performance, we consider that these metrics are a leading indicator of where schemes are at risk of not achieving their committed milestones and forecasted costs. At the end of the reporting year, of the 14 schemes providing data, the EVM reporting showed that nine schemes are both above budget and behind schedule. Further detail can be found in our interactive dashboard.

In the reporting year, we jointly commissioned a consultancy review with National Highways to assess the effectiveness of earned value measures as performance indicators in RIS2 and advise on the approach for use in future road periods. The final report recommends that to improve its effectiveness there needs to be consistencies in the agreed baselines between contractors and National Highways. We will be seeking that the company implements these improvements in Year 5 in preparation for the next period.