This chapter examines how HS1 Ltd has managed its network’s assets. We have focused our review on the following aspects:

- progress on addressing our and DfT’s PR19 recommendations

- asset performance, availability, condition and data

- asset management capability

- renewal planning and delivery

- progress on research and development (R&D)

- environmental sustainability

Delivery of PR19 asset management recommendations

HS1 Ltd’s commitments made at PR19 were either completed or are on track for completion by the end of the control period in March 2025. There were 28 commitments set by us for route management of assets and a further 11 set by DfT for the HS1 network’s stations. There are now 3 remaining commitments yet to be completed.

This year, HS1 Ltd successfully closed out 3 commitments:

- accreditation to the ISO55001 international standard, for route asset management. For its stations this was not a direct PR19 objective, but was also achieved;

- improvements to Life Cycle Cost modelling. This has been incorporated into HS1 Ltd’s PR24 planning, enabling a clearer line of sight from asset information to investment; and

- development of asset strategies with standardised asset hierarchies and risk and contingency forecasting. This has informed PR24 planning.

During the reporting year, progress on one key commitment was delayed: the requirement by the end of year 4 of the control period to be able to set the minimum data requirements for the assets; and to report on data quality in HS1 Ltd’s Asset Management Annual Statement.

This has not been achieved, however an audit completed by HS1 Ltd showed no recorded non-conformances and condition data recorded against 99.5% of assets.

HS1 Ltd has committed to closing out this action and reporting on data quality in its next Asset Management Annual Statement (AMAS) and has plans to undertake data improvements to support its proposed replacement asset data system in CP4.

Data is critical to mature asset management - it is discussed below and it will be considered in detail in PR24.

There are three recommendations still to be closed in the last year of the control period. We continue to monitor the progress of these recommendations via quarterly meetings with HS1 Ltd.

Current evidence reviewed shows all are on target and we are working with HS1 Ltd to ensure that learning from the work to date has been incorporated into its submissions for PR24.

Asset performance, availability, condition and data

Asset Performance - Route

This year the route incurred approximately 8,500 minutes delay due to asset issues. This is up from 7,100 delay minutes last year.

The increase is primarily driven by a number of significant incidents: there were 13 major incidents, (defined as those that led to more than 200 minutes delay), compared to 10 in the previous year and five the year before.

The most consistent causes of delay in the year were trespass onto the HS1 network and points failures, which is similar to previous years. HS1 Ltd recognises that it needs to do more to address these types of asset issues and has put in place plans to reduce them.

We think that HS1 Ltd needs to take a greater system leadership role in implementing better predict-and-prevent measures. As part of our current periodic review of HS1 Ltd (PR24), we are working with the company to understand its plans for efficient investment in controls to predict-and-prevent such issues, including the use of innovative technologies.

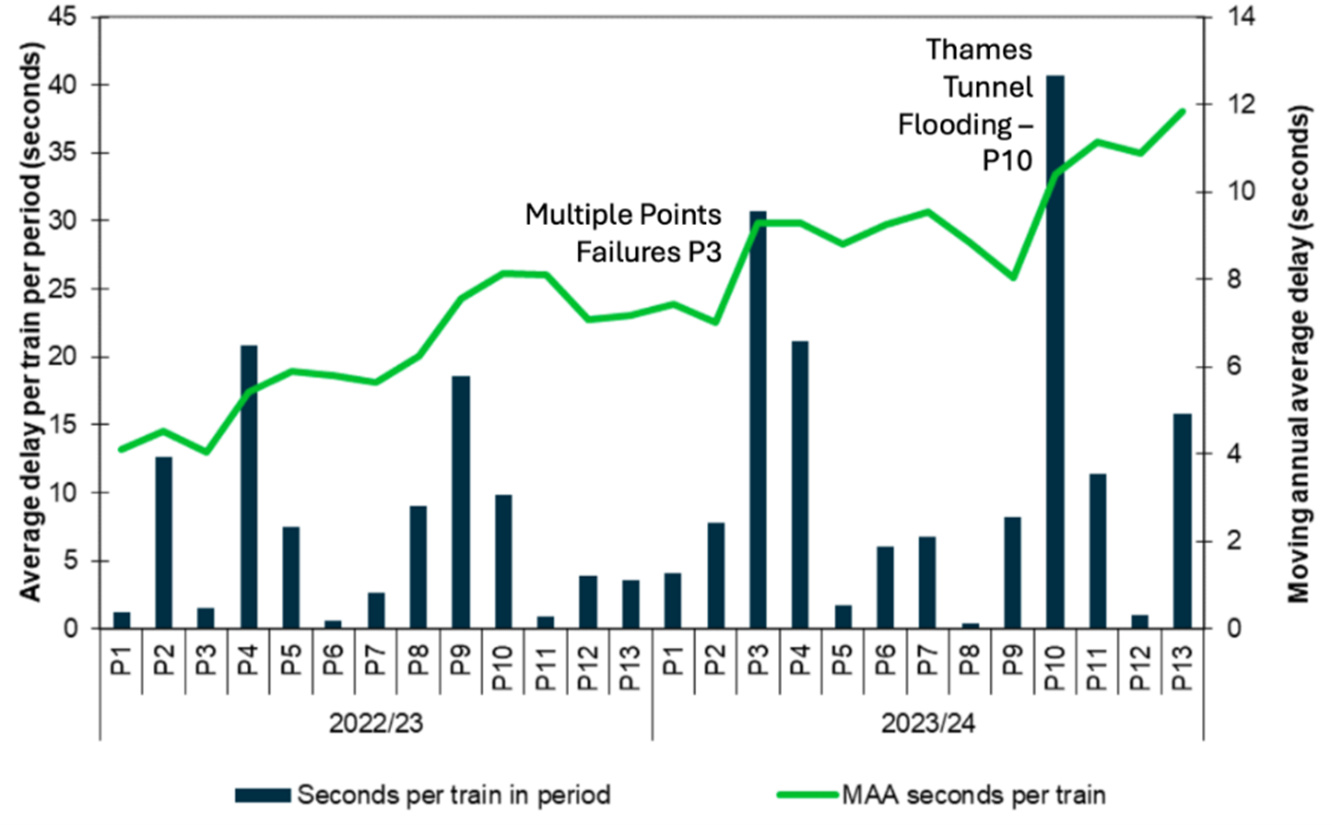

Figure 3.1 Delay per train and moving annual average by period, from April 2022 to March 2024, annotated by HS1 Ltd with causes for highest delay periods

Source: HS1 Ltd AMAS, 1 April 2023 to 31 March 2024.

Figure 3.1 shows that delays are not spread evenly over the year and are characterised by a small number of high-impact events.

This year there were two significant periods with delays: one in period 3 due to multiple points failures, and the other in period10 when the flooding of the Thames Tunnel caused severe disruption. Both these periods were worse than any in the previous year.

HS1 Ltd developed an asset resilience plan to address points failures at the end of the last reporting year, but this remains an area of focus for HS1 Ltd. The plan involved analysing critical assets; adjusting maintenance regimes; and upskilling those responsible for maintenance of the network.

We understand that the eight milestones of this plan have been met, and that additional work is planned to install additional targeted monitoring to help predict and prevent failure.

We have challenged HS1 Ltd to provide assurance to us that these actions are delivering benefits. We acknowledge that HS1 Ltd has improved its assurance processes for these assets over the last year.

As part of PR24 we have begun reviewing HS1 Ltd’s CP4 plan for evidence of lessons learned from failure trends, and plans to intervene on critical assets in future control periods.

The failure of both sump pumps at the Thames Tunnel between Christmas and New Year led to closure of both HS1 lines for 24 hours, and closure of one line for a further 24 hours.

This caused significant disruption to passengers. A technical investigation revealed that processes to alert that water levels were increasing were inadequate. The volume of water that entered the tunnel required a redesign of the overall system for managing drainage.

We think that if early warning systems had functioned more effectively then actions could have been taken earlier to mitigate this significant issue.

While additional ingress of water could not have been prevented by HS1 Ltd, it is entirely within HS1 Ltd’s asset management remit to ensure there is effective monitoring of water build-up at such a critical location – and robust operational procedures to deal with the build-up of water and its impacts.

This raises questions about the maturity of HS1 Ltd’s management of its drainage assets. We have begun scrutinising drainage asset strategies as part of the PR24 process, looking for evidence that this significant asset group is being managed in line with best practice.

The incident also raises wider questions about predict-and-prevent monitoring, and training of those responsible for maintenance and management of the asset.

Plans to address lessons learned and meet independent recommendations are underway by HS1 Ltd and we will seek assurances that those plans have been implemented in the coming year.

For trespass onto the network, the number of incidents was fewer than last year. A trespass strategy was introduced in June 2023 and a number of key initiatives implemented, but work is ongoing. London St. Pancras International station remained a target for trespass and further security improvements are planned for the coming year, including the use of close circuit television analytics to understand and mitigate trespass incidents.

In the coming year, we will continue to monitor progress of this strategy and our PR24 periodic review will look at how this feeds into specific asset strategies going forwards.

There were three dewirements in the reporting year which affected the HS1 network but were not within HS1’s infrastructure. Two of these had limited impact but one at the Eurotunnel boundary with the HS1 network in November 2023 left around 800 international passengers stranded for more than eight hours.

An independent report into this showed similar management challenges as with the November 2022 incident, mostly around ineffective system communication needed to resolve operations quickly. HS1 Ltd is working with operators and neighbouring infrastructure managers on a system response, including assurance of test exercises in the coming year to check for the implementation of independent recommendations.

We understand that R&D projects currently being undertaken by HS1 Ltd have shown evidence of the potential ability to detect overhead wire faults or train faults using onboard camera technology to avoid future incidents. In the coming year, we will be seeking clarity on the recommendations and the assurance plan, including how R&D solutions are being implemented.

In January 2024 there was a dewirement within HS1’s infrastructure at Singlewell, which caused a domestic HS1 service to be evacuated and passengers taken by bus to Ebbsfleet International station. This was the second dewirement within HS1’s infrastructure in the last two years (the first having occurred in November 2022 at Rainham, Kent).

The post-incident management of the latest incident suggested that some learnings from the previous incident had been implemented, however challenges remain around recovery and identifying the root cause. The root cause of the January 2024 incident has still not been determined.

For route asset availability, we look at two areas: power availability, and operational availability – with the latter defined as the percentage of time that a specific asset group is available for operational use, excluding planned maintenance. HS1 Ltd has met its targets for asset availability in these areas and we have no significant concerns.

Asset Performance - Stations

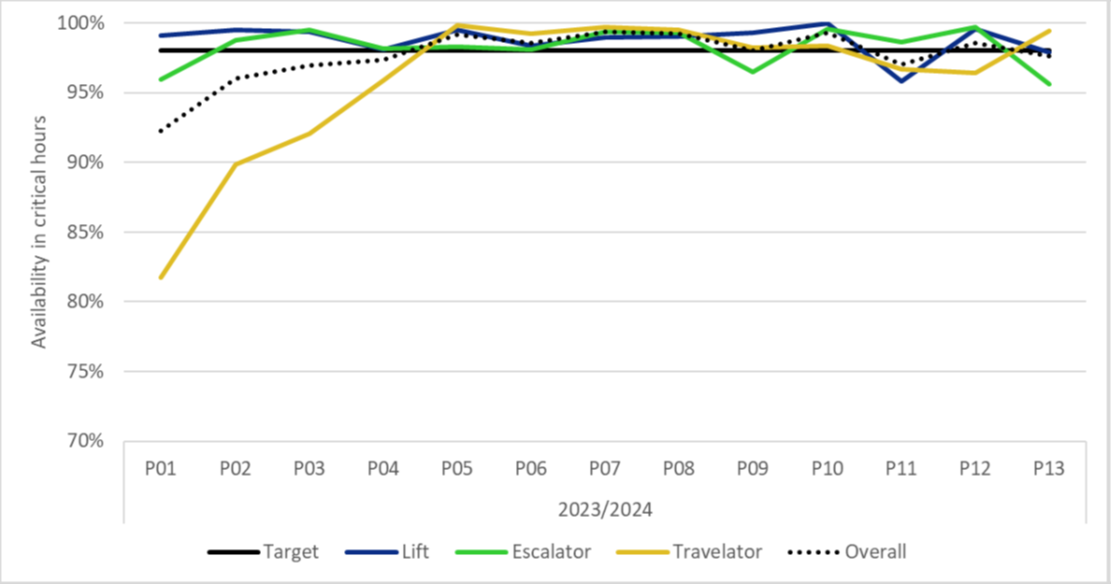

This year the main area of concern for the performance of assets at stations were lifts, escalators, and travelators (LETs) at the three stations managed by NR(HS). Availability against these targets is shown in Figure 3.2. Train operators continue to highlight to us that this has had a significant impact on their ability to manage pedestrian flows around the stations, and consequently on their passengers’ experience. While we recognise that availability this year has increased compared to the previous year, more needs to be done by HS1 to ensure the availability targets agreed with its operators are met consistently.

Since the previous year, NR(HS) has put in place a performance improvement plan with its LETs supplier which is showing signs of delivering better performance. In the coming year, we expect to see more initiatives to improve the supplier performance and better understand the data needed to predict and prevent failure. Over the next year we will be seeking clarity on HS1 Ltd’s plans to improve asset performance through improved data and evidence-based prediction as well as improvements in the management of obsolescence in this asset group.

The available asset data continues to show that greater deterioration than forecast at PR19 is a factor in the management of these assets. We consider that it is within HS1 Ltd’s control to make better use of its asset data and to revise its maintenance and renewals activities accordingly. We have seen evidence that HS1 Ltd and NR(HS) are drawing up plans to reflect this new asset knowledge. We will continue to monitor this in the coming year and we expect to see lessons learned reflected through the PR24 process.

Figure 3.2 Availability of lifts, escalators and travelators at the three NR(HS)-managed stations

Source: HS1 Ltd AMAS, 1 April 2023 to 31 March 2024.

Asset capability and condition

Route asset capability remained constant in the reporting period and is in line with expected degradation. The major incidents affecting HS1 infrastructure in the last year were not related to a change to the asset condition.

For its stations, HS1 Ltd will undertake asset condition inspections of all its stations in the coming year. As noted for lifts, escalator and travelator performance above, the available data continues to show that deterioration was greater than forecast at PR19. This rate of degradation is reflected in increased need for refurbishment and reduced availability of assets.

As noted above, we consider that it is within HS1 Ltd’s control to make better use of its asset data to update its maintenance and renewals activities and we will review this in PR24.

Asset management capability

We commend HS1 for achieving ISO55001 accreditation for asset management during this year. Better understanding of assets is crucial to reducing system costs and delivering asset availability more efficiently.

HS1 Ltd made good progress against its asset management targets in the reporting year. While more remains to be done to support the PR24 process, good work on understanding the track asset has been achieved and this is now best in class for asset management maturity, among the HS1 asset groups.

We will be commenting on asset management maturity further through the PR24 process, as each asset area has a different level of maturity, reflecting different technical challenges and different points in their lifecycles on HS1. It is good to see the overall management of assets has progressed since PR19 with new data-driven models now informing workbank planning for the 40-year asset plan.

We continue to encourage HS1 Ltd to develop this work across all of its asset base, sharing lessons and technology between assets groups.

The structure of asset management documentation continues to be in line with best practice. Updates in the reporting year moved HS1 Ltd closer towards being a data-driven risk and insight organisation.

We are supportive of the new assurance processes between HS1 Ltd and NR(HS). We understand that this work has been considered to establish the relationship between asset management decisions, performance and long-term asset sustainability for PR24.

We acknowledge good progress in the management of asset obsolescence with a full summary of parts and components now part of the annual report. Categorising the obsolescence risk in this way represents a step forward and enables more robust planning and prediction of future risk.

HS1 Ltd’s asset information strategy roadmap has encountered some delays this year prior to rolling out solutions and systems to support effective decision-making. A new enterprise asset management system is due to be rolled out in CP4 and we will be monitoring the impact of this on assurance activities.

We note that NR(HS) wishes to be a global leader in asset management by 2035, and an independent audit of its unified information strategy this reporting year showed no major non-conformances and three strong points, but also four opportunities for improvement. We are seeking clear evidence from both HS1 Ltd and NR(HS) during the PR24 process to understand how these opportunities will be realised.

Renewal planning and delivery

In our previous annual report, we acknowledged an improvement in HS1 Ltd’s assurance of changes to its renewals plan.

This reporting year, early modelling for PR24 was used to prioritise deliverable renewal work for the final years of CP3, with a view to more integrated ways of working to be tested (which will be essential for CP4, when the renewal volumes are significantly higher).

The volume of route renewals delivered was 120% of the volume planned at PR19. This is a total volume, combining different work across different asset types. We have reviewed this in detail, to ensure that higher total volume represents a benefit, in terms of better asset condition and lower whole life cost (as opposed to delivering a larger volume of ‘easier’ work types, with no benefit).

Similarly, over-delivery of volumes might not be ‘better’ than the plan, if the extra volume is due to assets degrading faster than planned and needing additional work. We are satisfied that the 120% volume delivery reflects a positive outcome, reflecting effective delivery on site and recovering some under-delivery in previous years.

This is an improvement from previous years (delivery was 35%, 68% and 73% of plan in Years 1, 2 and 3 respectively). It should be noted that the plan was adjusted to defer significant track volumes into CP4 following a deliverability review.

HS1 Ltd was able to accelerate other works into the plan making use of strike opportunities and better integrated maintenance and renewals planning. Further work is needed to report the efficiency of the change process, and we support a review of reporting to the quarterly stakeholder renewals board.

For HS1’s stations the volume of renewal delivered was 248% of the baseline plan for 48% of baseline cost. The number of changes to the plan and to individual schemes during the year is indicative of immature plans and estimates, rather than clear evidence of efficient delivery.

During the PR24 process we are seeking to ensure HS1 Ltd is achieving better asset management planning for station assets, to allow for more stable delivery plans in future control periods.

Line of sight between data-driven activity and asset renewal planning

We welcomed the introduction of an improved assurance regime in the reporting year to address concerns that we and other stakeholders had raised, about its reliance on lagging indicators to report progress.

After a year of using this new approach, leading indicators have allowed the start of better integrated asset management and renewal delivery conversations.

These indicators need to be continuously reviewed to ensure fitness for purpose going into CP4. We will continue to challenge HS1 Ltd to make the best use of assurance information to enable more stable, transparent delivery of its plans.

Research and development

At PR19, we encouraged HS1 Ltd to implement a research and development fund. Good governance of R&D funding is essential to ensure that investment is delivering real benefits; and that projects are stopped quickly if they are no longer viable. We note continued good control of research and development funding this year with HS1 Ltd meeting its planned milestones.

In the coming year, the last of the control period, we expect to see greater evidence of turning past R&D into innovation and delivery of benefits.

Where there are opportunities for wider system benefits, e.g. camera images from devices monitoring the contact wire interface with the train, we expect HS1 Ltd to take on a significant role in unlocking the system benefits.

Environmental sustainability

HS1 Ltd launched its sustainability strategy in 2020, setting out six priority areas: transparency; climate change & adaptation; energy use; resource use & waste impacts; biodiversity; and social impacts.

For each priority area, HS1 Ltd has set targets to 2030 and plans to deliver on these targets. It publishes annual detailed Environmental, Social, Governance (ESG) updates each June.

As part of PR24 we are reviewing its latest report alongside updates to its sustainability strategy, to ensure they are consistent with best practice – and that the pragmatic decisions made in operations, maintenance and renewals are consistent with the bold ambitions set out in HS1 Ltd’s high level strategy.